Unleashing FinTech Power: Rapyd's PayU GPO Takeover | 2023 #18

Weekly news up to Thursday, 3rd of August 2023

Hi there, you fellow Payments Enthusiast!

Welcome to this fresh newsletter, a dedicated Payments bulletin packed with Digital Payments and PayTech-related news!

It’s nice meeting you and I look forward to the insights and connections we’ll get by interacting here.

Don’t be shy; share your ideas, vision and knowledge to keep improving this newsletter!

Alright, let’s dive into this week’s hot payments news! 🚀💸

📣 Here’s the Takeaway for this Week:

Rapyd is paying $610 million to acquire a giant piece of PayU

👉What happened?

· Rapyd announced the acquisition of PayU Global Payment Organisation (GPO) of Netherlands-based Prosus, a global consumer internet group and one of the largest technology investors in the world, for a sum of $610 million;

· PayU GPO, a leading provider of best-in-class payment solutions to both enterprise and SMB segments in emerging markets, operates in over 30 countries worldwide;

· However, the deal will exclude PayU’s biggest payments market in India, as well as its units in Turkey and Indonesia.

🤔 Why is this relevant?

· The combination will unleash a truly integrated payments platform serving the world’s emerging and developed markets;

· Prosus retains a stake in PayU, focusing on India, its largest market. Prosus CEO Bob van Dijk said: "We're fully dedicated to the FinTech opportunity in India, where PayU is a major payment platform and making rapid strides in the credit market."

· Rapyd acquires PayU's operations in over thirty other markets, expanding its reach in Central and Eastern Europe and South America. The Israeli company offers payment services and issues credit cards, aiming to bolster its presence in these regions;

· Prosus, listed on Amsterdam's stock exchange since 2019, originated from South Africa's Naspers. Early investment in Tencent fueled a well-stocked investment portfolio. Rapyd has ties to Naspers through a recent collaboration with former Naspers-owned Multichoice Group. Furthermore, Israeli-based Rapyd actively engages in mergers and acquisitions, as seen with its acquisition of payment company Valitor in 2021.

· Rapyd’s acquisitions of PayU GPO and Valitor not only accelerates their expansion plans, it also fuels the rumours they’re gearing up for an IPO. 🚀💰 Exciting times ahead for Rapyd!

👉 Read the full release on the acquisition over here

💡Any other notable things happened in Payments?

⭐️ Klarna scraps open banking brand Klarna Kosma by Tech.eu

🤝 Nexi acquires 30% stake in Computop by Finextra

I hope these quick bites have brought you up to speed again, and let’s keep a close eye on ‘Payments’ for the week to come..;-)

Cheerio and until the next,

Wouter & Marcel

Onwards to the other payments news!

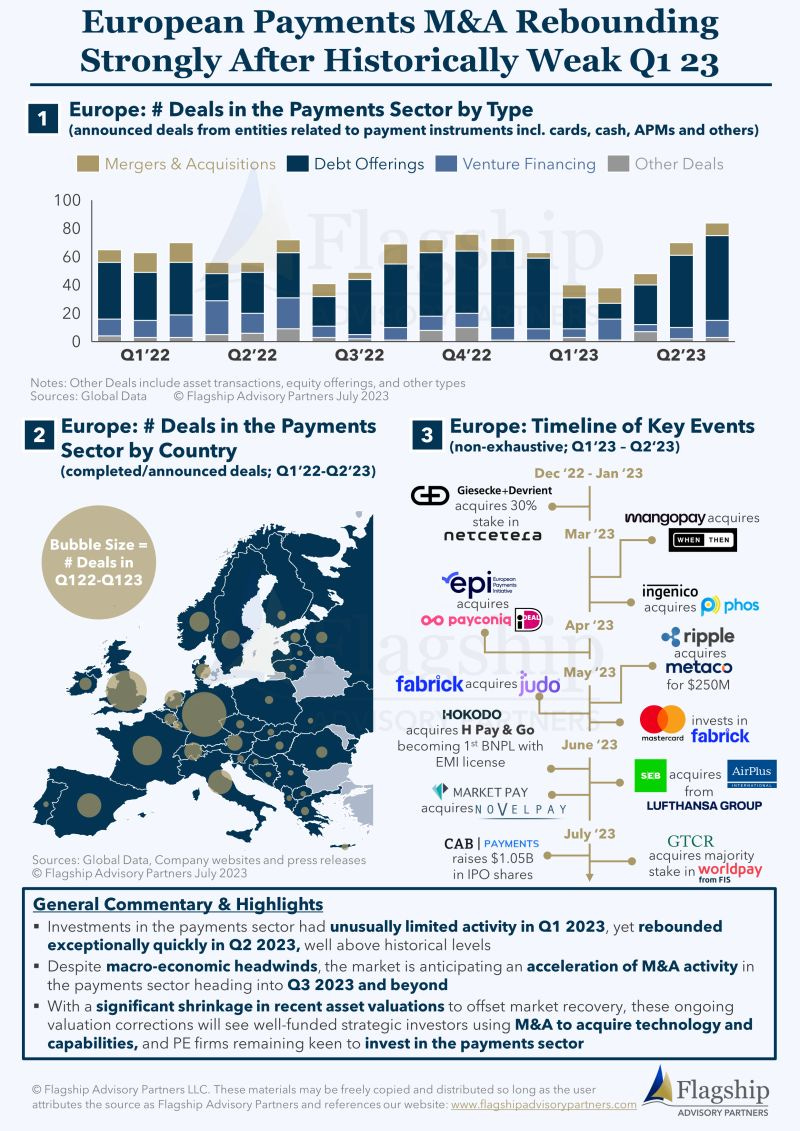

REPORT

BNPL allows consumers to split up the cost of a retail transaction (usually between $50 and $1,000), traditionally into four interest-free installments repaid over the span of six weeks.

👀 NEWS HIGHLIGHT

Since launching in the market in February 2022 less than 18 months ago, Klarna has achieved a rapidly expanding network of over 640,000 active consumers; processed over 2 million orders.

📊 INFOGRAPHIC

📰 ARTICLE

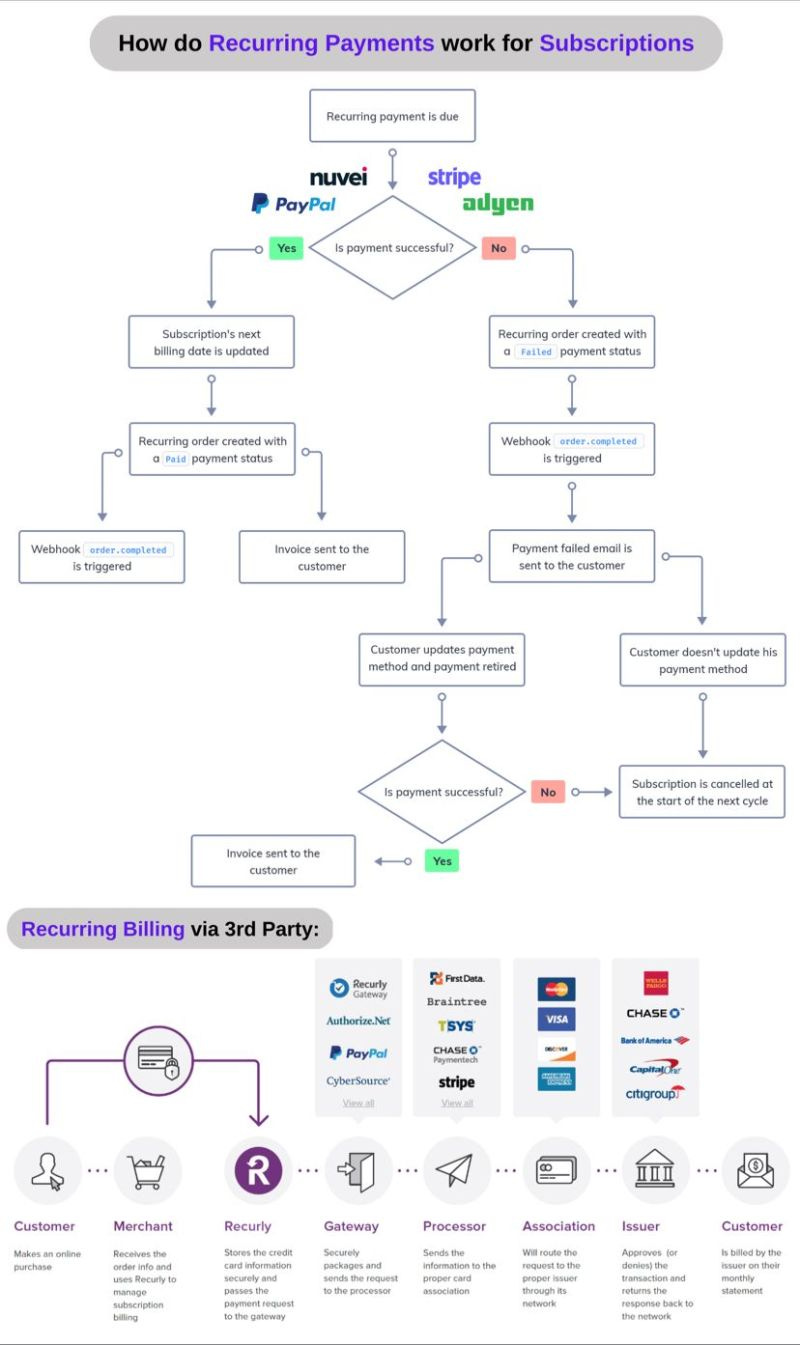

Recurring payments, especially for subscription-based services, may appear to be simple but in reality, are quite complex.

Payment Expert Arthur Bedel 💳 ♻️ explained it very well, so I like to share it here with you (and see the picture below👇):

Here are 6️⃣ benefits of Embedded Payments at Uber Eats:

Of all the innovations to disrupt the financial sector in recent years, embedded payments is both one of the most promising and one of the trickiest to take advantage of.

Unified Payments Interface (UPI) is India's mobile-first instant payments system that allows customers to make interbank peer-to-peer and peer-to-merchant payments using a virtual payment address, transforming digital payments nationwide.

Paytm seems to have found the secret sauce at last. After years of rolling out seemingly unrelated digital financial services, the Indian fintech giant is instead focusing on lending and seeing its revenue rise accordingly. In the first quarter of the 2024 fiscal year, Paytm’s revenue rose 39% year-on-year to 23.42 billion Indian rupees (US$286 million).

👨💻 BLOG

These seven impact areas illustrate why implementing SCT Inst has a severe impact on a PSP’s transaction processing chain.

INNOPAY has identified the following seven high-impact areas for PSPs that are working on the implementation of SCT Inst:

💬 INTERVIEW

Thunes has disrupted how cross-border payments are made. Establishing a new infrastructure for money movement, it connects the world’s fastest-growing and largest economies across 130 countries.

The Paypers interviewed Peter De Caluwe, the CEO of Thunes, on the company’s rapid growth and Series C funding announcement.

💡INSIGHTS

Here is an overview of real-time/instant payments around the globe👇

New payment flows and Click to Pay transactions surged for Mastercard in the second quarter of 2023 as consumers and businesses continued to turn to digital channels as their spending remained buoyant.

In this second edition prepared by Kushki and Americas Market Intelligence, they will delve into the advances, innovations, and obstacles of digital payments in LATAM.

Shift4 is taking direct aim at competitors like Toast.

Last week, the publicly traded company announced it would pay restaurants that install its point-of-sale (POS) system $1 per online order for the first 3 months, plus a bonus of up to $5,000 for switching.

A recent report from Duplo, a business payment platform serving African businesses of all sizes, has shed light on the development of key B2B payment processes in Africa.

While the dog days of summer won’t be here for a few months, it seems that financial fatigue has bank customers in the U.S. feeling the heat.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 PAYMENTS HIGHLIGHTS

⭐️ Zelle outage at JPMorgan Chase is red flag for banks.

⭐️ Optty adds cryptocurrencies as a payment option.

⭐️ Zil Money unveils Payment Link for small businesses.

⭐️ Nexi acquires 30% stake in Computop.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

PayPoint has launched Confirmation of Payer or Payer Name Verification service to its suite of open banking solutions.

EUROPE 🇪🇺

Zalando has partnered with Savrr, a relatively unknown start-up until recently. Together, they offer German Zalando customers a new service: ‘save now buy later’, the counterpart of ‘buy now pay later’.

USA 🇺🇸

Aevi is pleased to announce its strategic partnership with technology provider Bleu, bringing the convenience of touchless, tap-to-pay functionality to merchants across North America and Europe.

Eco Inc just unveiled a decentralized payments project called Beam, a P2P crypto transfer service aiming to be a ‘global Venmo’.

Microsoft and PayPal are expanding their partnership to allow Xbox owners in the United States to use Venmo as a payment method for games, movies, TV shows and apps from the Xbox store.

GlossGenius raises $28M to expand its bookings and payments platform for beauty businesses.

Weave a leading all-in-one customer experience platform for small and medium-sized businesses, announced an expansion of their payments platform with the addition of Mobile Tap to Pay.

Melio announced the launch of Pay Over Time, the first product that enables small businesses to pay vendors and business bills in monthly installments, while their suppliers get paid in full and on time.

Stripe has launched a tax feature for businesses to connect to, enabling them to streamline their taxes in a connected all-in-one solution.

ASIA

Alchemy Pay partners with Checkout.com. Through this partnership, Alchemy Pay has seamlessly integrated Checkout.com's Visa and Mastercard channels into its On and Off-ramp.

Finmo has received a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS).

AUSTRALIA 🇦🇺

Airwallex has announced its partnership with OurCrowd, the global venture investing platform. For the first time, institutions and individual accredited investors will have the ability to invest in startups anywhere.

MIDDLE EAST

Sav has introduced a save now, buy later feature to promote disciplined savings among residents amid increasing price pressures and higher borrowing costs.

The Saudi Central Bank (SAMA) permitted Tabby to provide Buy Now Pay Later (BNPL) solutions.

noon.com has launched noon Pay, a peer-to-peer payments service for its users in KSA and the UAE.

MOVERS AND SHAKERS

Stripe cofounder John Collison joins Sifted Summit. The fintech founder will be joined on stage by EF cofounder Matt Clifford.

Stax Payments announced the appointment of Paulette Rowe to Chief Executive Officer, taking over for John Kristel.