Welcome to our latest edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments

Blockchain-enabled Payments can revolutionize the global payments industry with faster and cheaper payments👇

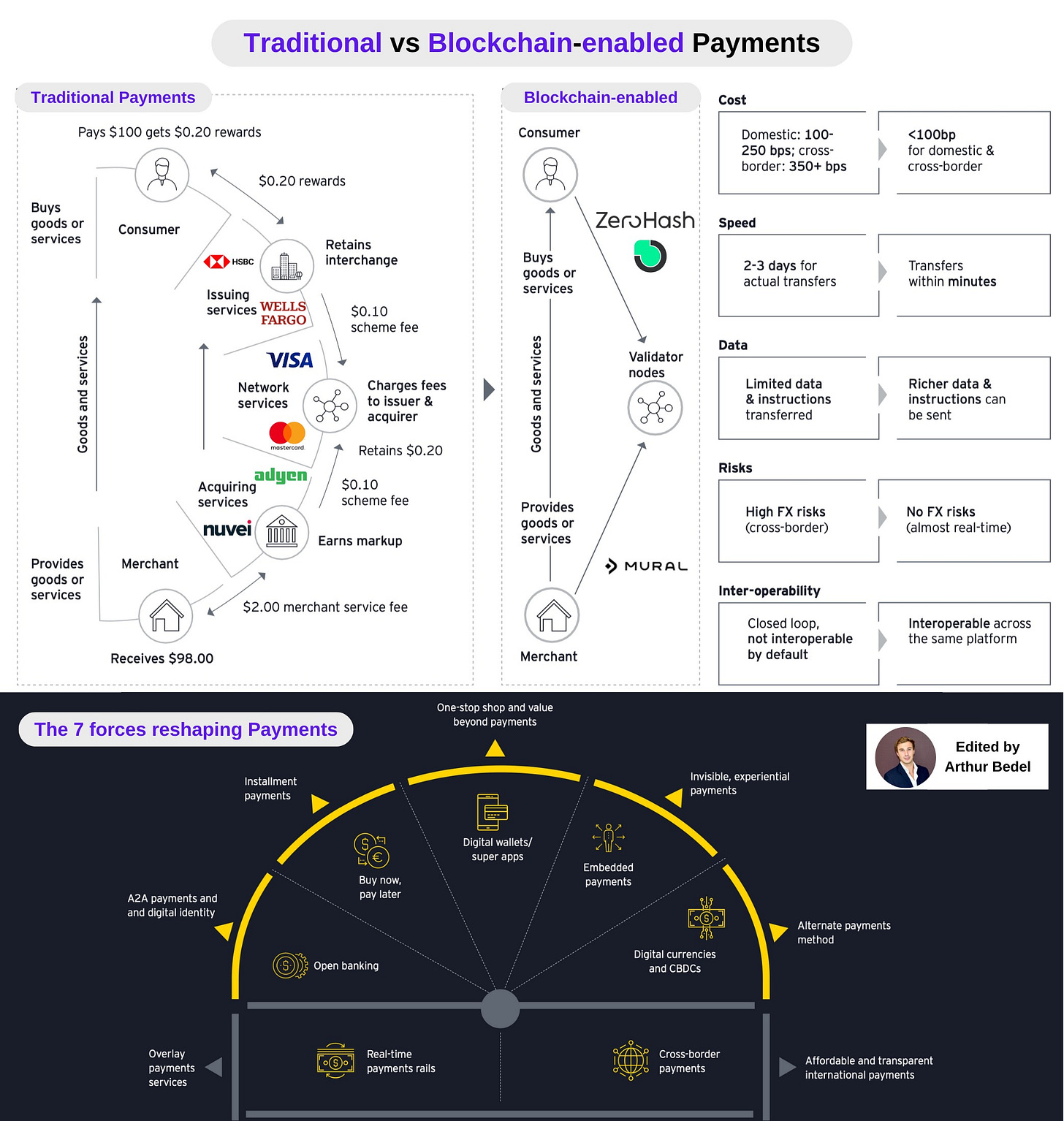

The next wave of disruption in payments is tied to technology and the blockchain is a pretty fascinating one. Most people only associate it with crypto. The blockchain is the underlying technology of cryptocurrencies, the actual gem.

Until recently, payments have been enabled through the traditional model by those 6 main players:

👉 Issuers - Wells Fargo, Citi

👉 Acquirers - Nuvei, Adyen

👉 Card Schemes - Visa, Mastercard

👉 Payment Orchestration - Spreedly, Gr4vy, Inc

👉 Payment Methods (APMs) - Klarna, Alipay, Accrue Savings, Trustly

👉 Token Vaults - VGS, Basis Theory

This complex model creates various points of failure, an expensive process, friction and less transparency, especially in cross-border transactions.

Digital currencies and CBDCs are gaining momentum and rising to the top of the agenda for innovative PSPs that are looking for regulated, fast and global alternatives.

As a result, more payments and cryptocurrency ecosystem providers are entering the market:

👉 Global Cryptocurrency Market Cap: $2.56T

👉 Bitcoin Market Cap: $1.26T.

What to know:

🔸Major blockchain and cryptocurrency infrastructure providers are expanding into payments. Binance launched a payments technology company, Bifinity to enable fiat-crypto payments.

🔸Traditional payments companies have also entered the crypto market. Consumers can now make payments with cryptocurrencies linked to Visa and Mastercard cards. PSPs - Nuvei, Stripe, PayPal - can transfer, receive and send cryptocurrencies - Pay With Crypto, powered by organizations like Zero Hash.

Here are the major benefits to use the blockchain for Global Payments:

✅ Immediate

✅ Cheap

✅ Global reach

✅ Settled in a secure settlement medium

✅ Data Enrichment

✅ Lower Risk (Higher Acceptance)

✅ Interoperability (Open Loop)

There is also a need to address to concerns to keep increasing adoption:

❌ Regulations

❌ Liability

❌ Trust

Overall, stablecoins and crypto payments powered by Zero Hash, Mural and others have the potential to disrupt the industry, starting with those uses cases:

🔸Global Remittances

🔸eCommerce Transactions

🔸Subscription-based Payments

🔸MicroPayments

🔸Heding against currency devaluation

🔸Capital efficiency in Trading

👉 Financial Inclusion

Other forces are also reshaping the payments industry:

🔸Real Time Payments Rails

🔸Open Banking

🔸Buy Now Pay Later

🔸Digital Wallets & Super Apps

🔸Embedded Payments

🔸Digical Currencies and CBDCs

Technology is driving & disrupting payments! The rise of digital currencies, Bitcoin Halving & the AI boom are making it happen.

Source: EY's report - How the rise of PayTech is reshaping the payment landscape

Sign up & Follow:

✍️ The Payments Brews ☕️: https://lnkd.in/g5cDhnjC

✍️ Connecting the dots in payments... & Marcel van Oost by Arthur Bedel