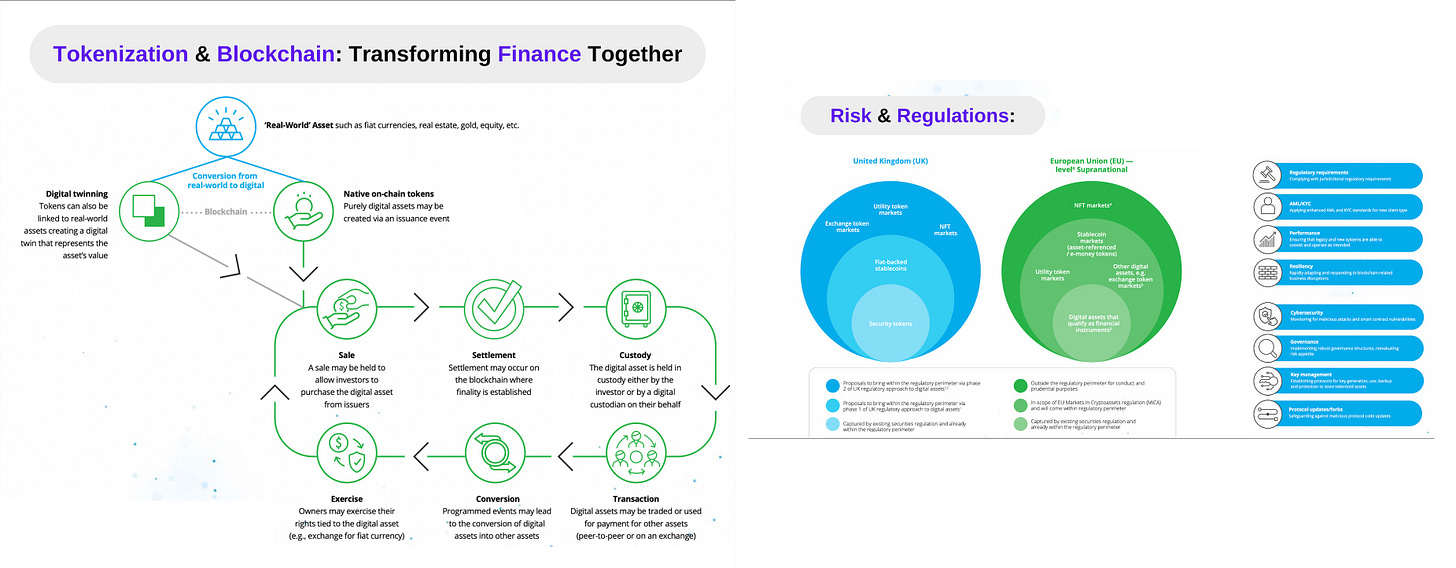

Tokenization & Blockchain: Transforming Finance Together.

Insights from Arthur Bedel.

Welcome to our latest edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments.

Tokenization on the Blockchain is empowering the financial sector with smart contracts, automated transactions & digitalization of assets 👇

What is #Tokenization:

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. This approach enables assets —ranging from real estate and art to stocks and bonds — to be divided into shares or tokens that represent a stake in the underlying asset. These tokens can be bought, sold, and traded more efficiently and securely, making previously illiquid assets more accessible to a broader range of investors.

——

How the Blockchain improves Tokenization:

Blockchain technology significantly enhances the process of tokenization through its inherent features of:

🔸Decentralization

🔸Transparency & Immutability

🔸Security

🔸Global Accessibility

👉 By providing a decentralized & immutable ledger, the blockchain ensures the authenticity and ownership of tokens can be verified at any time, reducing fraud and increasing trust. #Smartcontracts automate transactions and enforce the terms of a token sale or transfer, streamlining operations and reducing costs associated with intermediaries.

——

The Lifecycle of a Tokenized Asset:

🔸Real-world asset — fiat currencies, real estate, gold, equity... — gets converted to a digital asset on the Blockchain through the processes of:

👉 Digital twinning — Tokens linked to a real world asset (digital twin) representing the assets value

👉 Native on-chain tokens — Purely digital assets may be created via an issuance event

🔸Once tokenized, the asset can have various purposes:

1️⃣ Sale - a sale may be held to allow investors to purchase the digital asset from issuers

2️⃣ Settlement - a settlement may occur on the blockchain where finality is established

3️⃣ Custody - the digital asset is held in custody either by the investor digital custodian

4️⃣ Transaction - Digital assets may be traded or used for payment for other assets (P2P or on an exchange)

5️⃣ Conversion - Programmed events may lead to the conversion of digital assets into other assets

6️⃣ Exercise - Owners may exercise their rights tied to the digital asset (I.e. exchange for fiat currency...)

——

Challenges & Considerations:

Tokenization on the Blockchain also introduces risks:

🔸Regulatory Requirements

🔸AML / KYC

🔸Performance

🔸Resiliency

🔸Cybersecurity

🔸Governance

🔸Key Management

🔸Protocol updates/forks

Check diagram above for more explanations on each one of those key challenges

——

Tokenization is just one great example of the potential the Blockchain can disrupt the financial sector and world as we know it 🚀

Source: https://lnkd.in/ggPrUa7y by Deloitte

-----

✍️ Sign up to The Payments Brews ☕️: https://lnkd.in/g5cDhnjC

✍️ By Arthur Bedel & Connecting the dots in Payments...