Welcome to our latest edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments.

Banking as a Service, an innovative FinTech model of powering companies with "white-labeled integrated financial services":

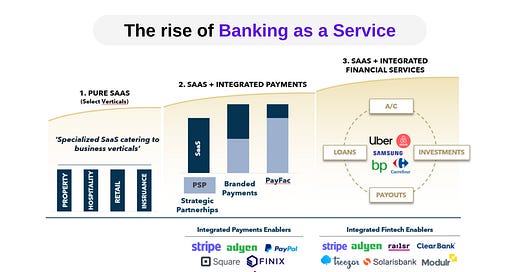

SaaS, (Software as a Service) and ISVs (Independent Software Vendors) saw massive upsides in integrating financial services starting with payments, a theme that investors loved (largest investment category in FinTech). Integrated payment services matured due Nuvei, Adyen, Stripe, and other PSPs offering the tech and enabling infrastructure for SaaS to embed payment services across use cases.

Definition of Banking as a Service (BaaS):

👉 BaaS fintechs offer white-labeled plug-and play licensed financial products that enable FinTech (e.g., neobanks, lending, wallets, PSPs, etc.) and corporates (e.g., fuel, insurance, retailers, etc.) to embed these products into their own customer journeys. By providing a multi-layered infrastructure, FinTech companies offer decoupled or integrated financial products ranging from:

🔸Accounts Creation

🔸Lending — YouLend

🔸Card Issuing — Marqeta & Brex

🔸KYC / KYB — Plaid

🔸Payouts — Payoneer & Dwolla

🔸Pay-ins — Too many to include

🔸Crypto — Zero Hash, Mural, Circle

🔸and more!

BaaS fintechs are likely to power next-generation SaaS models. Companies like Shopify, Salesforce Commerce Cloud, Adobe Commerce, VTEX and others are embedding BaaS products to offer those white labeled under a B2B and B2B2C model:

🔸Pure SaaS

🔸SaaS + Integrated Payments

🔸SaaS + Integrated Financial Services

Fintechs were clearly the early drivers of demand for BaaS, but large corporates (Amazon, Carrefour Airbnb...) are now using BaaS services. These corporates aspire to integrate fintech products into their customer user journeys to increase customer stickiness, drive brand loyalty, and benefit from new fintech revenue streams.

Not all BaaS have the same product portfolio, however. The underlying BaaS license is a key determinant of the products that can be offered. For example, having a banking license offers the possibility of offering deposit accounts , and a range of credit products. In contrast, an electronic money institution (EMI) or payments institution (PI) license enables several payment products, but not deposit accounts or lending.

Solaris SE and Railsr are examples of BaaS providers with broad product coverage. Banking Circle and Modulr Finance are more focused on bank payments and virtual IBANs (though Banking Circle also enables merchant and B2B lending).

BaaS is part of the Embedded Finance trend that companies are diving head first into. The benefits are clear, stickiness, revenue generation, cost-savings and creating a better consumer experience whether on the B2C or B2B side 🚀

Source: Flagship Advisory Partners - https://lnkd.in/gc5hhXM9

Sign up & Follow:

✍️ The Payments Brews ☕️: https://lnkd.in/g5cDhnjC

✍️ Arthur Bedel, Connecting the dots in payments... & Marcel van Oost