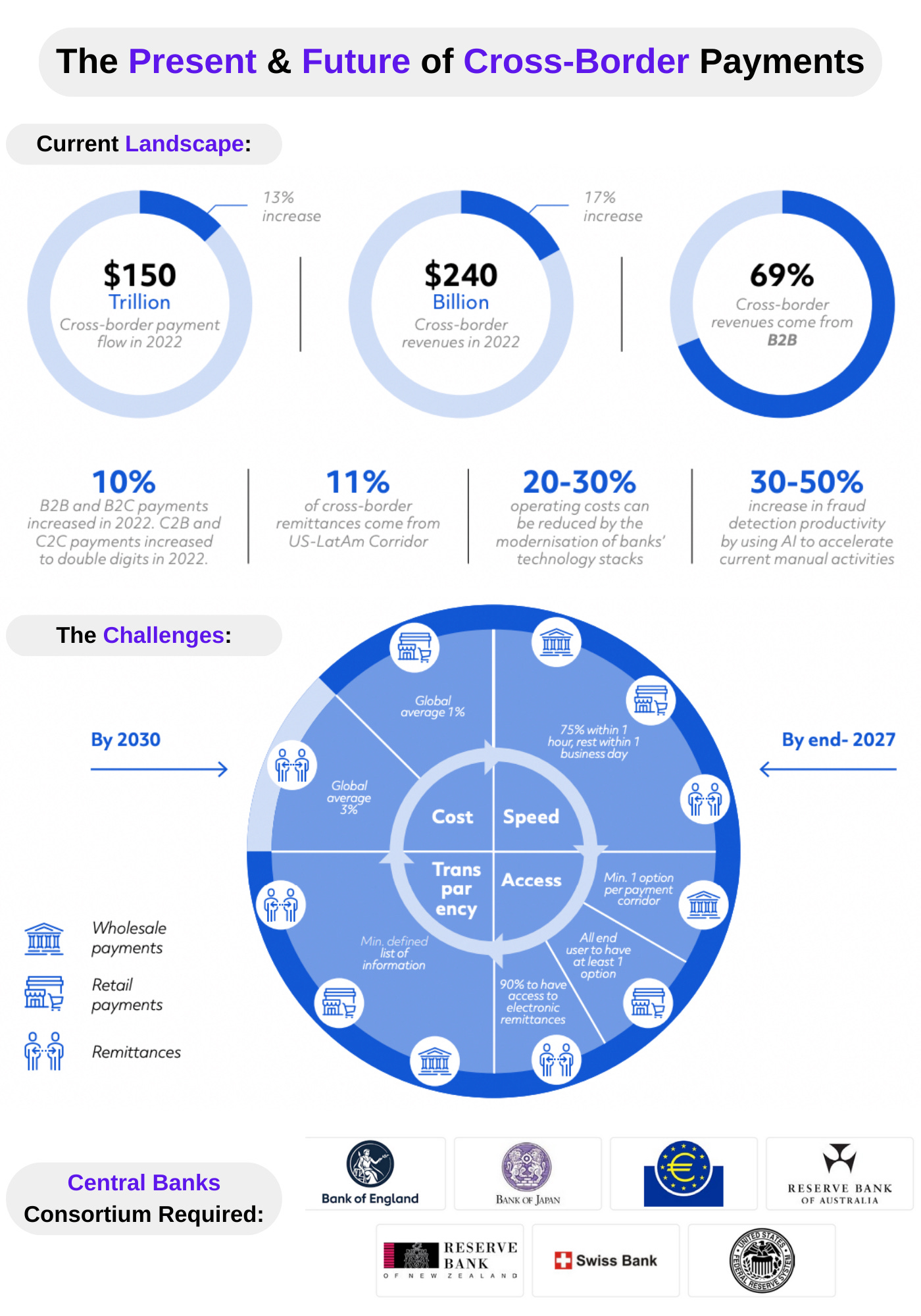

The words "Cross-Border Payments", have been a synonym of "nightmare" in the payment space for many of us. This $150T+ market is finally right for disruption👇

Today, Cross-Border Payments are slow, expensive, available through a very small percentage of Financial Institutions, and only if the recipient has a bank account. Banks - Chase, Santander, BNP Paribas etc - have had control over this market for decades. The lack of competition never incentivized the industry to drive innovation and efficiency.

As the world continues to grow into a global marketplace without borders, the number of cross-border transactions will keep increasing and the current challenges continue to slow the economy down - Cost, Speed, Access and Transparency.

1️⃣0️⃣ Key Takeaways to disrupt this market:

🔸A greater pivot to tech solutions from legacy is needed for Real Time Identity Authentication to happen.

🔸 The regulatory obsession with efficiency is premature. The focus needs to be on cooperation and innovation. Efficiency in payments is ultimately acceptance and cost per transaction which technology will improve.

🔸 A need for a truly autonomous, supranational agency to harmonize regulations and requirements. Driving cross-border payments cannot succeed while national interests can ultimately override decisions.

🔸 Technology needs to redefine the correspondent bank role. Smaller banks across regions need to be included. Digital settlements and automation of manual processes will help with regulations.

🔸"High Risk" classification needs an overhaul - via the ID Authentication Key. Remittance rules are getting more complexed, time to set global standards.

🔸 Domestic and Cross-Border players need to share technology and best practices.

🔸 Liquidity Optimization is key. We all know cash-flow is queen and cross-payments payments are slower to settle which is a major opportunity for innovative players like Nuvei, Adyen, Trustly.

🔸 Economic reset will make it hard for innovative startups to get funding and will skew the overall competitive landscape.

🔸 Crypto, CBDCs, blockchain: not the

answer but a component. The technology itself can help create a global infrastructure to improve the global payment landscape (down to argue***).

🔸A group of like-minded nations and central banks need to collaborate to issue global standards for KYC, KYT, AML regulations and more to enable innovation globally.

👉 In conclusion, the overall disruption of cross-border payments will require time and the cooperation of nations, central banks and many more players. Technology and a fresh breath of innovation is key.

2024 is the disruption year for Cross-Border Payments. Check out Visa Direct and MastercardSend 🚀

-----

Hit the 🔔 on my LinkedIn to stay updated with the latest Payment Initiatives & follow Connecting the dots in payments... ‼️

#globalpayments #payments #fintech #techology