Welcome to our first edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments.

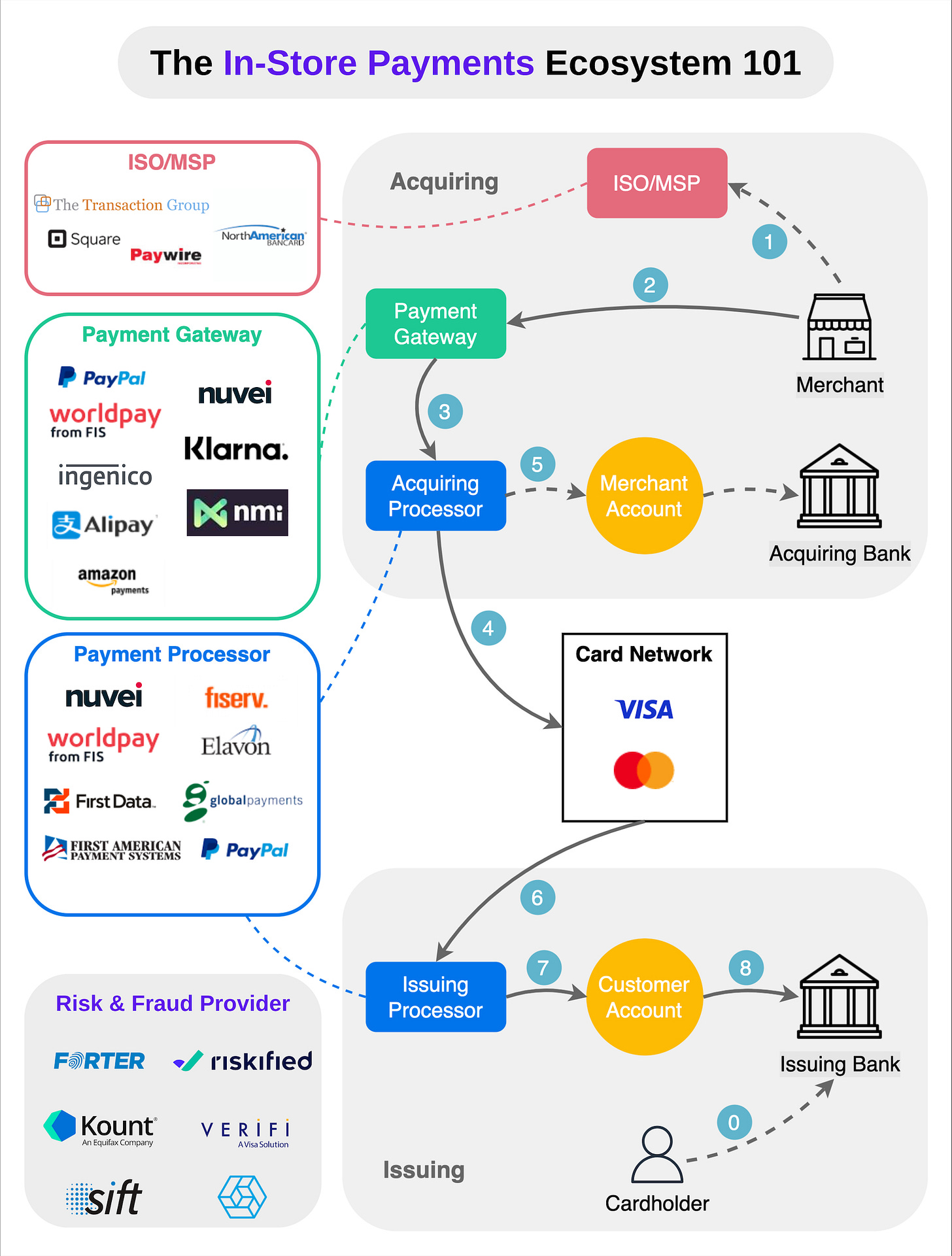

The In-store Payments Ecosystem 101 - Gateways, Acquirers, Issuers, Card Networks, Risk & Fraud providers and ISO/MSP. Easy peasy👇

For a payment transaction in-store to take place, a legacy payment process also mostly called Card Present (#CP), there needs to be a few players involved:

👉 Issuer

👉 Acquirer

👉 Card Network

👉 ISO / MSP

👉 Merchant

👉 Customer

🔸Steps 0-1: The cardholder opens an account in the #issuing bank (Wells Fargo, Chase, Bank of America…) and gets the debit/credit card. The merchant registers with ISO - Square (Independent Sales Organization) or MSP - The Transaction Group (Member Service Provider) for in-store sales. ISO/MSP partners with payment processors (Nuvei) to open merchant accounts.

🔸Steps 2-5: The acquiring process.

The payment gateway (Cybersource, Nuvei, Braintree) accepts the purchase transaction and collects payment information/data. It is then sent to a payment/acquirer processor (who often can be the same as the payment gateway - Nuvei, Fiserv, Elavon, Inc.) which uses customer information to collect payments. The acquiring processor sends the transaction to the card network. It also owns and operates the merchant’s account during settlement, which doesn’t always happen in real time.

🔸Steps 6-8: The issuing process.

The issuing processor talks to the card network (Visa, Mastercard, American Express) on the issuing bank’s behalf. It validates and operates the customer’s account.

🔸Once the funds have been credited/deposited, in this case for either debit or credit card transactions, the transaction is finalized ✔️

Today, this process is becoming more complex with additional services being offered by payment service providers including Banking-as-a-service (#BaaS), #embeddedfinance, Insurance Services etc which will ultimately provide additional value to customers and merchants altogether.

👉 The real question is, how can merchants continue to deliver a seamless experience to consumers (even improve that experience) while adding risk/fraud features and financial services to the mix?

👉 My guess? The hardware will play a major role and the in-store experience as we know it today will change entirely, potentially dis-including in-person payments altogether.

It may sound unreal but it is happening 🚀

-----

Hit the 🔔 on my LinkedIn to stay updated with the latest Payment Initiatives & checkout Connecting the dots in payments... ‼️

#globalpayments #payments #technology #fintech #instorepayments