Welcome to our latest edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments

ApplePay is a work of art — enabling Omni-channel transactions (online and in-store), & here is how? 👇

ApplePay was launched in 2014. Only 4 years later, the company processed 1B+ transactions a year!

👉 In 2019, it reached 1B+ MONTHLY transactions and launched its offering partnering with Goldman Sachs and Mastercard.

👉 In 2020, Apple expanded its payment services to Europe, the Middle East and APAC and jumped into the BNPL trend by partnering with Zip Co and soon Afterpay!

👉 In 2021, it helped Coinbase, Kraken Digital Asset Exchange and other cryptocurrency exchanges go mainstream from a payment perspective by facilitating card transactions and launched its own ApplePay Later solution.

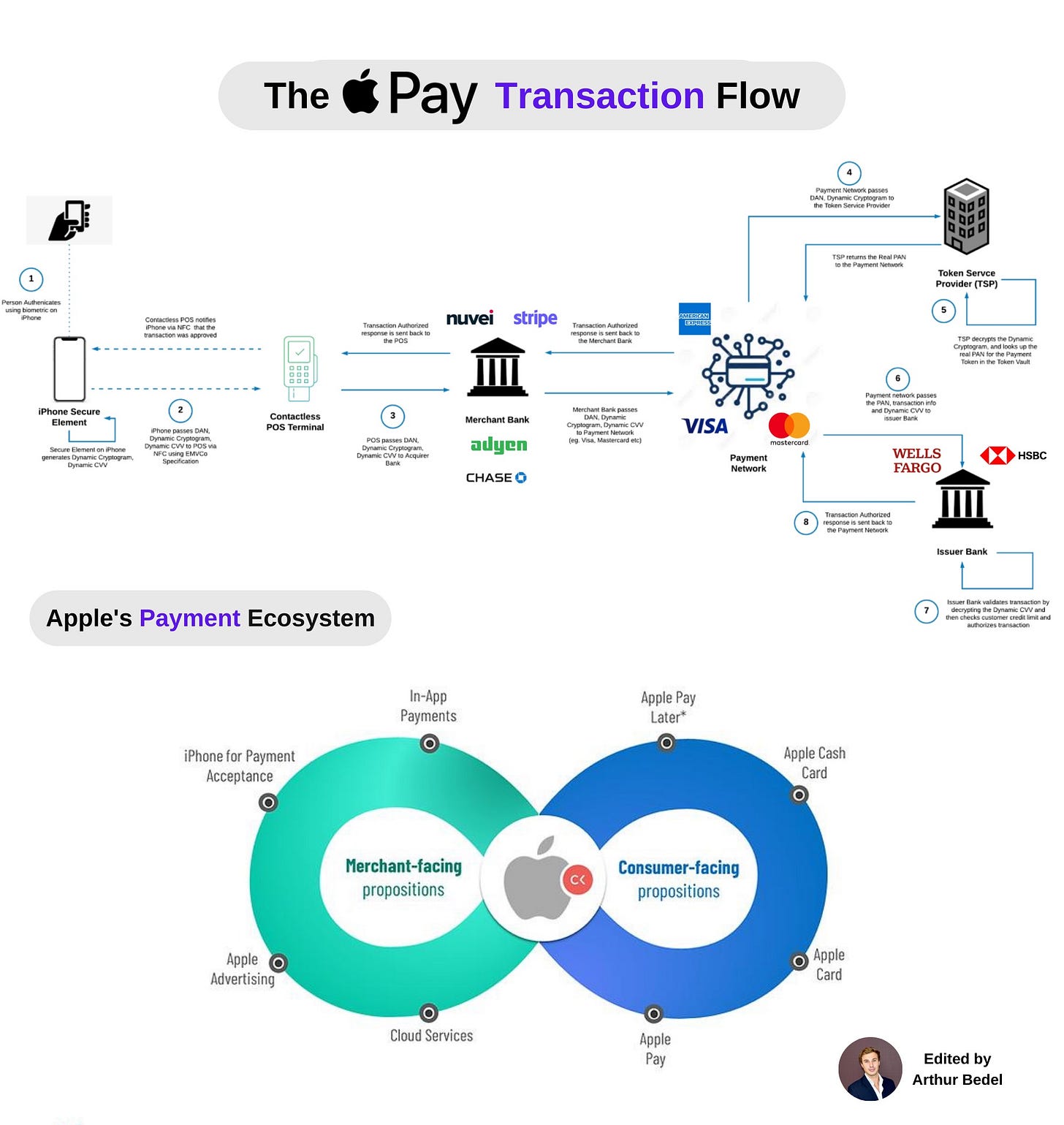

In the above payment scenario, ApplePay uses NFC to send payment data to the contactless POS terminal with its Tap & Pay feature:

🔸At checkout, a consumer chooses ApplePay to purchase a good or service. First, they need to authentificate themselves to the IPhone Secure Element (SE) using Biometrics (Fingerprint, Face ID or PIN).

🔸Once authenticated, the Secure Element generates a Dynamic Cryptogram, combination of Payment Token, Transaction Amount, Transaction Counter etc and a Dynamic CVV. The Secure Element passes the Payment Token (DAN), Dynamic Cryptogram and Dynamic CVV alongside other information to the POS Terminal via NFC.

🔸 The POS sends this request to the Acquirer Bank (Merchant Bank, Nuvei, Stripe...) which in turn forwards it to the Payment Network — i.e. Visa, Mastercard etc.

🔸The Payment Network (also called Card Network) identifies the specific Payment Token and passes it and the Dynamic Cryptogram to the Token Service Provider (TSP) to obtain a Payment Card Number (PAN).

🔸The Token Service Provider receives the Payment Token (DAN) and the Dynamic Cryptogram. After verification, it returns a real PAN to the Payment Network.

🔸The Payment Network passes the PAN along with the transaction details and CVV to the Issuer Bank - Wells Fargo, Bank of America for authorization.

🔸The Issuer validates the request by deciphering the Dynamic CVV using its private key to check the credit balance against the transaction amount.

🔸If authorized, the Issuer Bank passes back the authorization response to the Payment Network, back to the Acquirer and finally the POS system of the Merchant

This happens lightning fast and with extreme convenience. Apple built its payment ecosystem with Apple Card, Apple Cash, ApplePay Later and various other services like In-app payments to achieve a seamless User Experience (UX) to both the Merchant and Consumer.

Sign up & Follow:

✍️ The Payments Brews ☕️: https://lnkd.in/g5cDhnjC

✍️ Connecting the dots in payments... & Marcel van Oost by Arthur Bedel

this is very descriptive.