Revolutionising Travel Payments: dLocal and eSky Group Aim to Unleash Game-Changing Solutions in Latin America and Africa | 2023 #34

Weekly news up to Thursday, 23rd of November 2023

Hi There, you fellow Payments Enthusiast!

Welcome back to this fresh newsletter, a dedicated Payments bulletin packed with Digital Payments and PayTech-related news!

Alright, let’s dive into this week’s hot payments news! 🚀💸

📣 This week’s main topic:

dLocal and eSky Group strategically unite to transform payments in Latin America and Africa, prioritising local acquiring and innovation for an enhanced customer experience

👉What happened?

· dLocal Expands Partnership with eSky Group: Emerging markets payments provider, dLocal, has extended its partnership with eSky Group, a travel platform. The collaboration aims to integrate payments with modern airline and travel capabilities;

· Focus on Latin America and Africa: The two companies are committed to delivering improved payment solutions in the markets of Latin America and Africa. Since their initial partnership in 2021, they have worked together to enhance the payment experience in key regions, including Brazil, Chile, Colombia, Mexico, Peru, and South Africa;

· Joint Efforts for Efficiency: The collaborative efforts between dLocal and eSky Group revolve around local acquiring, with the goal of decreasing processing costs, accelerating settlement, upgrading customer support, and improving authorization rates for customers in the specified countries;

· Enhancements in Payment Processing: According to eSky Group officials, the partnership has led to increased authorization rates and improvements in payment processing, including streamlined refunds. The companies plan to introduce installment payment options and additional alternative payment methods to further enhance their position in Latin America and Africa.

🤔Why is this relevant?

· Strategic Focus on Emerging Markets: dLocal's focus on enabling local payments in emerging markets aligns with the global trend of expanding financial services in regions with growing economies. The partnership with eSky Group demonstrates a strategic commitment to addressing the unique payment needs of Latin America and Africa;

· Innovation in Travel and Payments: The collaboration emphasises a joint commitment to innovation in the intersection of travel and payments. By prioritising local acquiring and introducing new payment options, the companies aim to elevate the overall customer experience in these dynamic markets;

· Broader Trend in FinTech and Digital Payments: dLocal's recent collaborations, including partnerships with Jeeves, inDrive, and ACE Money Transfer, reflect a broader trend in FinTech and digital payments. These partnerships showcase a comprehensive approach to offering secure, convenient, and localised payment solutions across different sectors and regions;

· Response to Customer Needs: The introduction of installment payment options and alternative payment methods reflects a response to evolving customer preferences. As the payments landscape continues to evolve globally, companies are actively adapting to meet the diverse needs of consumers, contributing to a more inclusive and customer-centric financial ecosystem.

You can read the full press release over here

(The graphic above shows the Airline & Travel Payments - B2B Vendor Landscape 2024, all credits for the infographic goes to Paul van Alfen)

💡Any other notable things happened in Payments?

⭐️ Adyen’s global ambitions in Chicago

🤝 Form3 and Klarna partner for European payments

I hope these quick bites have brought you up to speed again, and let’s keep a close eye on ‘Payments’ for the week to come..;-)

Cheerio and until the next,

Wouter

Onwards to the other payments news!

REPORT

As we look at the top fintech and payment trends for 2024, it is important to examine the wider context before we get into the specifics. It is clear that this is a market undergoing seismic changes – payment preferences and technologies are changing quickly in different markets, all across the world.

👀 NEWS HIGHLIGHT

The Financial Conduct Authority’s new authorization allows it to continue operations in the UK market just as a temporary approval it received in the aftermath of Brexit was due to expire in just five weeks, according to a statement.

The Stockholm-based company established a UK-based entity, Klarna Financial Services UK, to offer all of its consumer-facing products in the country.

📰 ARTICLE

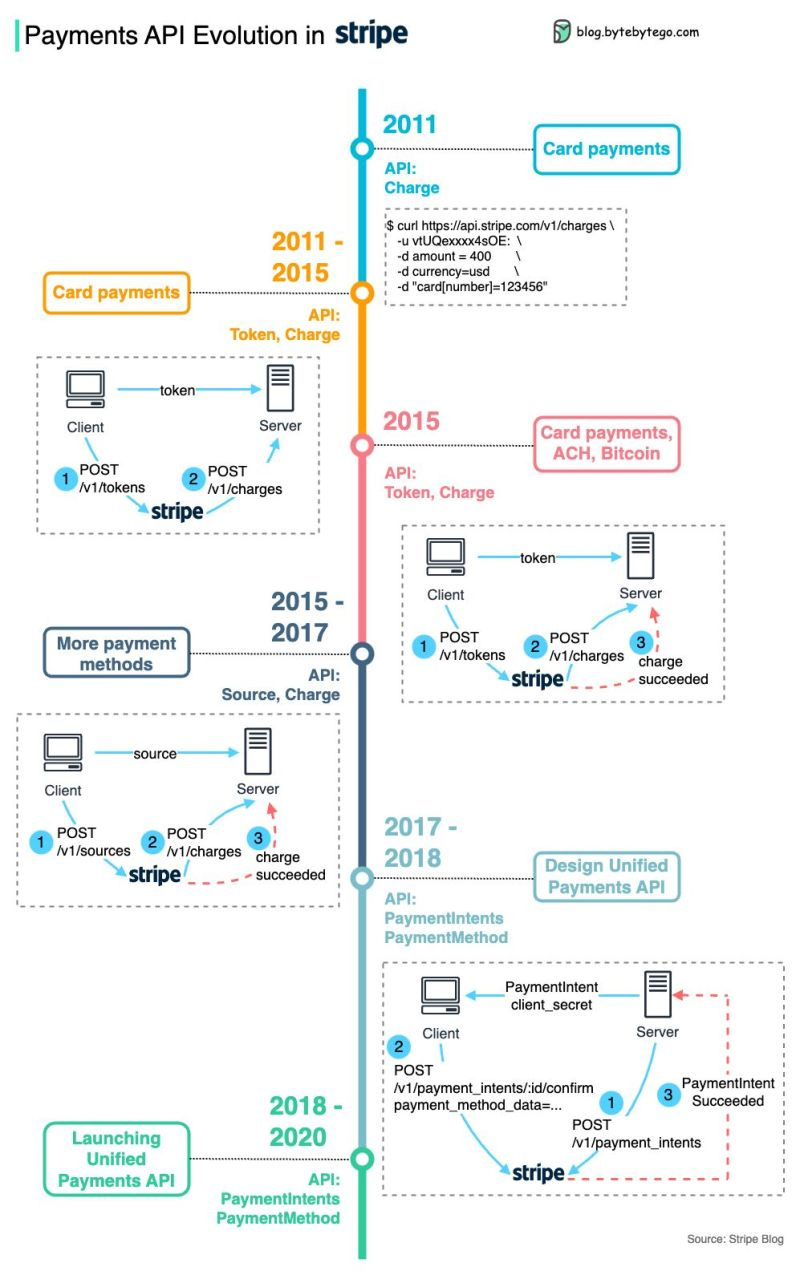

The diagram below shows Stripe's payments API evolution👇

This 100% Brazilian innovation offers an instant payment system, where money transfers are immediate, enhancing efficiency and convenience. It's particularly beneficial in a country where traditional bank transfers can take days.

This article presents a comprehensive analysis of PSD3, encapsulating its evolution, key components, implications, and the roadmap ahead.

By addressing a range of challenges and opportunities, PSD3 aims to reshape the payment landscape and establish a foundation for a more secure, competitive, and accessible financial ecosystem.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 PAYMENTS HIGHLIGHTS

⭐️ Apple faces class-action lawsuit over Crypto Payment restrictions.

⭐️ Škoda rolls out Pay to Fuel to enhance post-refueling service.

⭐️ Toss joins race for key payment gateway for tourists.

⭐️ UPI’s success story is going global.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Lithuania's Paystrax launches in the UK after receiving its Payment Institution License from the FCA earlier this year.

PokerStars selects Plaid for seamless payments. UK users can now “Pay by Bank” using Plaid’s Payment Initiation Service (PIS) technology.

UK payments report calls for alternatives to Mastercard and Visa. The conclusions of the Future of Payments Review echo longstanding complaints across Europe about heavy reliance on the American duo for card payments.

EUROPE 🇪🇺

Klarna employees “shocked” after CEO’s speech addressing a proposed union strike, in which he appeared to liken pro-strike employees to the rebelling pigs in George Orwell’s Animal Farm, sources say.

SeQura and Checkout.com enter into a strategic partnership to increase merchant conversion rates by offering consumers fast, flexible, and secure payment methods.

The European Parliament and the Council of the European Union have reached a provisional agreement on the European instant payment proposal.

USA 🇺🇸

PayPal takes a stance and says blockchains are the new financial rails and states that that its stablecoin PYUSD is responding to customer needs.

Alaska Airlines and Stripe roll out Tap to Pay on iPhone for easier in-flight payments.

ASIA

Mastercard Singapore and FOMO Pay to allow SGQR payments by scanning cards aligned with EMVCo Merchant-Presented QR standards.

Mumbai-based B2B payments firm PayMate expands reach to Singapore, Australia, and Malaysia. The company aims to offer customized digital payment solutions globally.

Person-to-person (P2P) cross-border fund transfers are now enabled via PayNow and DuitNow between Singapore and Malaysia.

Fintech startup Kiwi raises $13 Mn to expand credit on UPI offerings, and to keep improving customer experience.

AUSTRALIA 🇦🇺

Visa Australia proposes preferential interchange rate for SMEs. Visa is slashing the fees incurred by small businesses for sending debit card payments through its network.

Touch2Pay secures $3.2m in pre-Series A2 Funding as total capital reaches $6.3m. The fresh capital will be utilised to accelerate product development.

MOVERS AND SHAKERS

Checkout.com appoints Mariano Albera as new Chief Technology Officer. Mariano will accelerate the evolution of Checkout.com’s platform and focus on offering merchants high-performance payments.