Welcome to our latest edition of "Connecting the Dots in Payments with Arthur Bedel," where we explore the dynamic world of financial transactions and innovations alongside this esteemed payments professional. Join us as we uncover insights and trends shaping the future of payments.

QR Code Payments appear everywhere, from Restaurant menus to Super Bowl advertising. These square-shaped black & white codes are taking on the world of payments by storm 👇

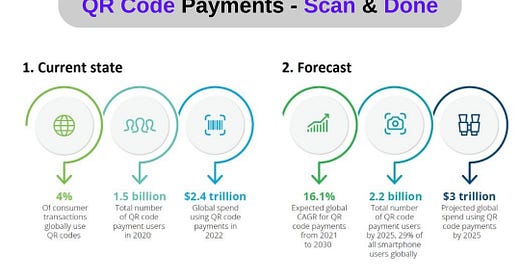

As companies and consumers have grown increasingly comfortable with #QR codes, more companies are adopting them for payments. Influenced by COVID19, contactless payments rapidly gained in popularity over traditional payment methods, a trend likely to continue over the next five years. Today, 4% of consumer transactions globally use QR codes, and that number is expected to increase at a 16.1% CAGR by 2030.

Originally, invented in 1994 by Denso Wave in Japan, they were used for production, tracking and shipping in the auto industry. Today, some of the largest companies have incorporated that technology for various purposes:

🔸 Payments - Venmo, Alipay, Nuvei

🔸 Returns - Kohl's and other retailers

🔸 Loyalty - McDonald's, Starbucks, LVMH

🔸 Marketing - Coinbase, Taco Bell, National Basketball Association (NBA)

This technology, usable across all channels, is a creative, inexpensive and efficient way to bypass card rails and old POS hardware. Today QR codes account for more than 90% of mobilepayments in China 🇨🇳 with Alipay & WeChat Pay. From commerce to entertainment and beyond everything in China can be paid for using QR codes. Africa is following in APAC's footsepts.

3 key features of QR code payments benefit customers and merchants:

🔸 Contactless payment experience: Using a digital payment option eliminates the need for cards or cash.

🔸 Faster payment, service, and settlements: Digital transactions enable immediate payment, convenience, accurate records, and prompt settlement between financial institutions.

🔸 Affordable and accessible functionality: Lower setup and transaction costs help merchants pass savings along to consumers.

Note💡 - Currently, merchants have two choices to consider when implementing

QR payments:

🔸 Customer-presented code: The customer presents a QR code for the merchant to scan. Merchants can choose to build their own app for a customer-presented method or choose to accept third-party apps, such as Zelle®, Venmo or PayPal

🔸 Merchant-presented code: The merchant's POS system produces a QR code for the customer to scan with a mobile device. In most cases, the customer manually inputs their payment details. A unique code is generated for each transaction.

Acquirers and PSPs, like Nuvei, are also leveraging the QR code technology to embed a checkout experience across channels, that merchants can leverage across all industries. Worth seeing 🚀

QR codes are here, growing globally. Don't overlook that technology, it might as well be the key to your processing issues.

Source: Deloitte

———

✍️ Sign up to The Payments Brews ☕️: https://lnkd.in/g5cDhnjC

✍️ Follow Connecting the dots in payments...

------

Hit the 🔔 on my LinkedIn to stay updated with the latest Payment Initiatives & checkout Connecting the dots in payments... ‼️