Klarna cuts losses and sees “huge opportunity” in generative AI | 2023 #22

Weekly news up to Thursday, 31st of August 2023

Hi There, you fellow Payments Enthusiast!

The most interesting news within Payments came in just this morning, as Swedish FinTech unicorn Klarna announced it’s turning things around following a bruising 2022, which saw its valuation cut by 85% and the company lay off 700 employees.

In the second quarter of 2023, its losses decreased by 77% on the same period last year.

Its second-quarter results, released on Thursday, show the cuts made to the business in 2022 are continuing to have a positive impact on its finances.

Read the full Sifted-article over here

Can Trustly and Slimpay's Collaboration Reshape the Future of Recurring Payments in Europe?

Some other ‘big news’ came in from the Nordics as well, as Swedish open banking and payments firm Trustly announced the acquisition of French FinTech Slimpay.

In a €70 million deal, the Swedes are acquiring the A2A-based recurring payments platform. This move serves a dual purpose: to advance Trustly’s European expansion efforts, and also to revolutionise the recurring payments experience for businesses and customers throughout Europe and the United Kingdom.

While the transaction is still subject to customary regulatory approvals, Trustly, which competes with card companies and digital rivals like PayPal, plans to use the deal to expand into repeating payments such as subscriptions or donations.

And there they fulfilled a need, because the demand for subscription models remains high – even in times of high inflation rates, according to a study FinTech company Riverty published last December.

While households in Europe estimate they have four subscriptions the average is ten completed subscriptions.

Conducted among nearly 6,000 respondents between the ages of 18 and 74 years old from Germany, the Netherlands, Sweden, Finland, Denmark and Norway, the survey shows that people are increasingly interested using products and services as part of subscription models.

In terms of payment, customers expect to find their favorite payment methods: among Gen Z and millennials digital wallets/mobile payment or BNPL are in vogue.

In a landscape where the demand for subscriptions and recurring payments is growing, offering the payment solution in the right way is crucial for merchants. And that's precisely what the collaboration between Trustly and SlimPay promises to achieve; to improve conversion rates for merchants, and to enable customers to easily pay bills, subscribe to services and choose flexible payment plans.

What do you think: will the partnership between Trustly and Slimpay revolutionise Europe's Recurring Payment experience?

Feel free to share your ideas, vision and knowledge to keep improving this newsletter!

You can read the full release about Trustly’s acquisition of SlimPay over here

💡Any other notable things happened in Payments?

⭐️ These are the most popular Buy Now, Pay Later options by country, by Merchant Machine

🤝 Nave partners with Mastercard to offer APAC’s online traders instant cash-outs, by FinTech Global

I hope these quick bites have brought you up to speed again, and let’s keep a close eye on ‘Payments’ for the week to come..;-)

Cheerio and until the next,

Wouter & Marcel

Onwards to the other payments news!

REPORT

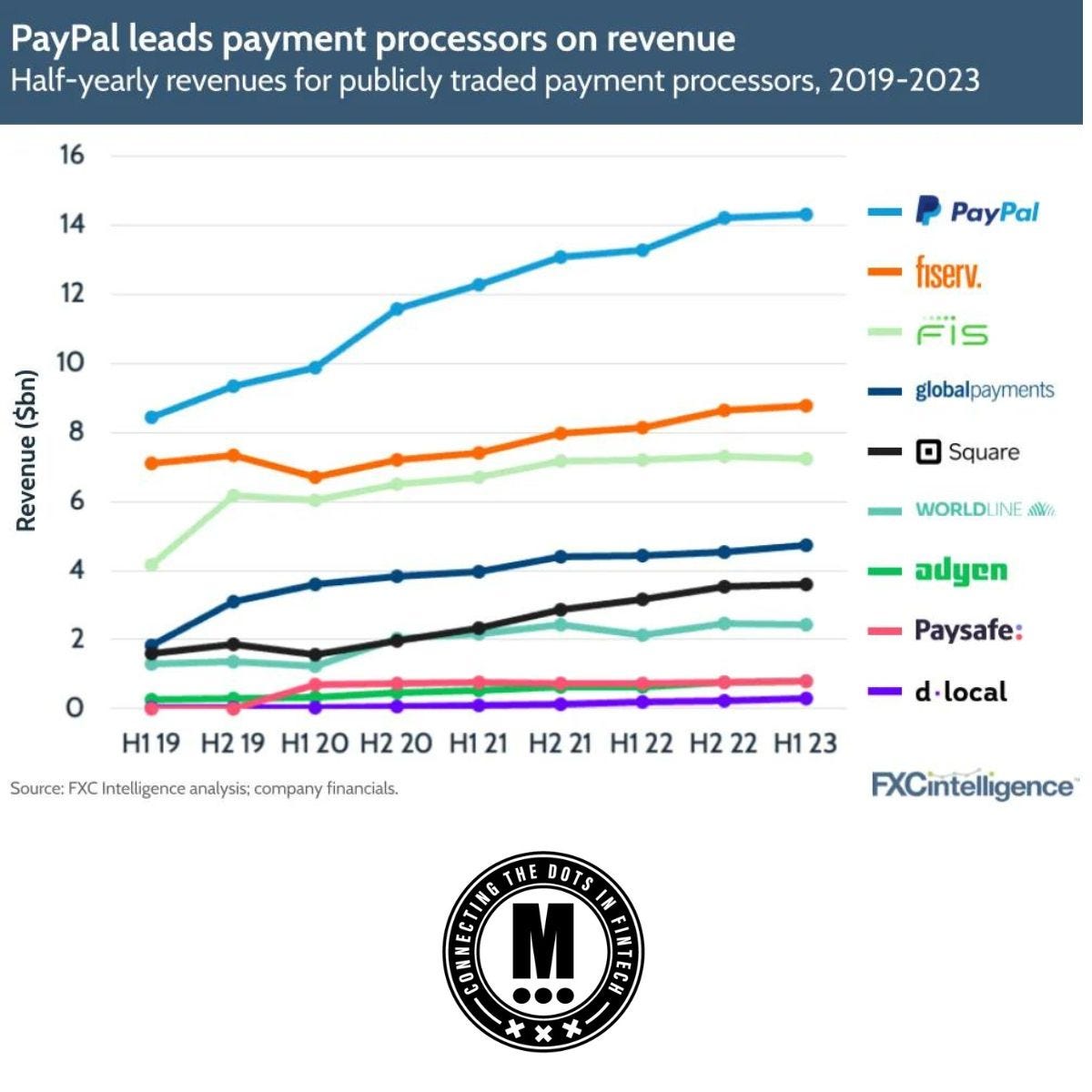

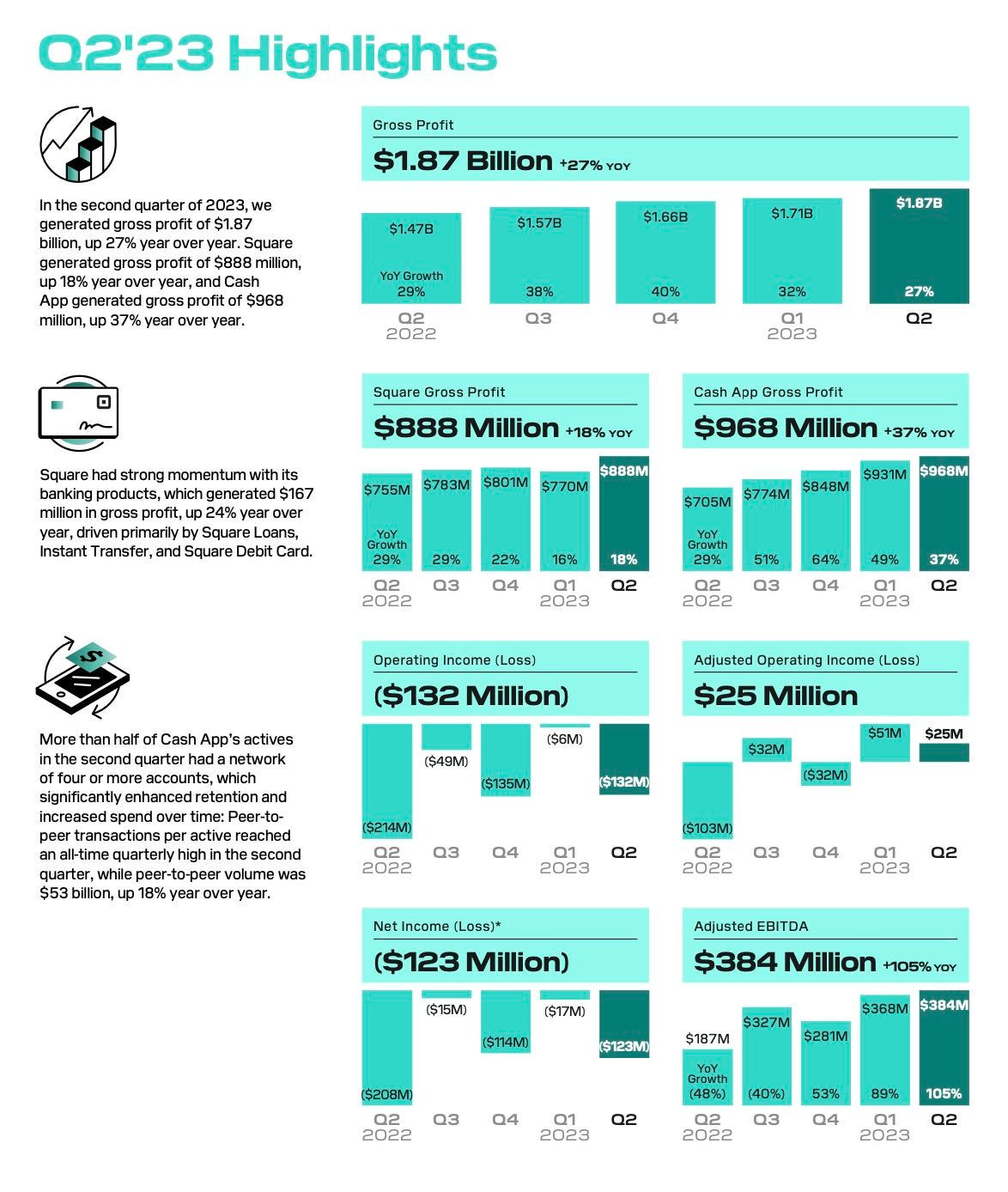

The Q2 2023 earnings season for payment processors was marked by stability and subtle transitions, a welcome respite after the highs and lows driven by the pandemic.

👀 NEWS HIGHLIGHT

SEPAY has announced it will merge with Buckaroo as of the 1st of September to create solutions for an omnichannel payment experience.

In addition to the current services offered by Buckaroo, customers will have access to payment solutions where they can buy, lease or rent payment terminals for processing in-store payments. Officials have stated that both new and existing customers can expand their offerings with mobile and fixed payment terminals. This will allow consumers to experience improved convenience and flexibility while completing payments.

😎 SPONSORED CONTENT

The Integrated solutions for startups and SMEs, with more than 45k merchants, achieving more than 1 million transactions per day worth $11 million.

📰 ARTICLE

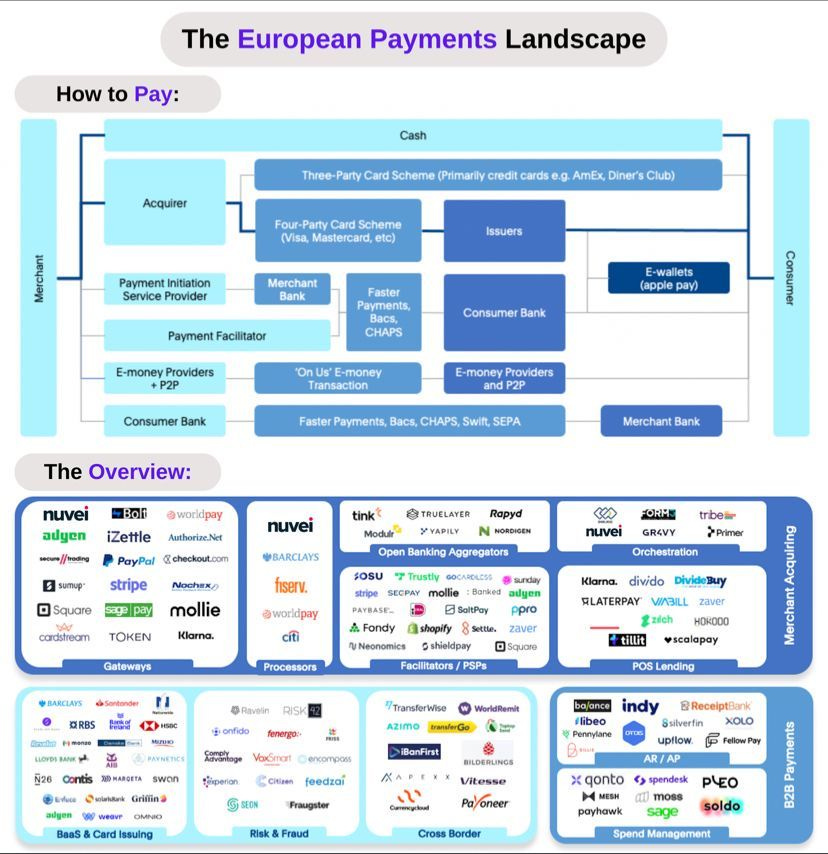

In Europe, crossborder payments are widely used and a necessity. Traditional banks have owned that process for years without creating speed nor innovation, failing to respond to the changing consumer demands for embedded Foreign Exchange solutions.

💡INSIGHTS

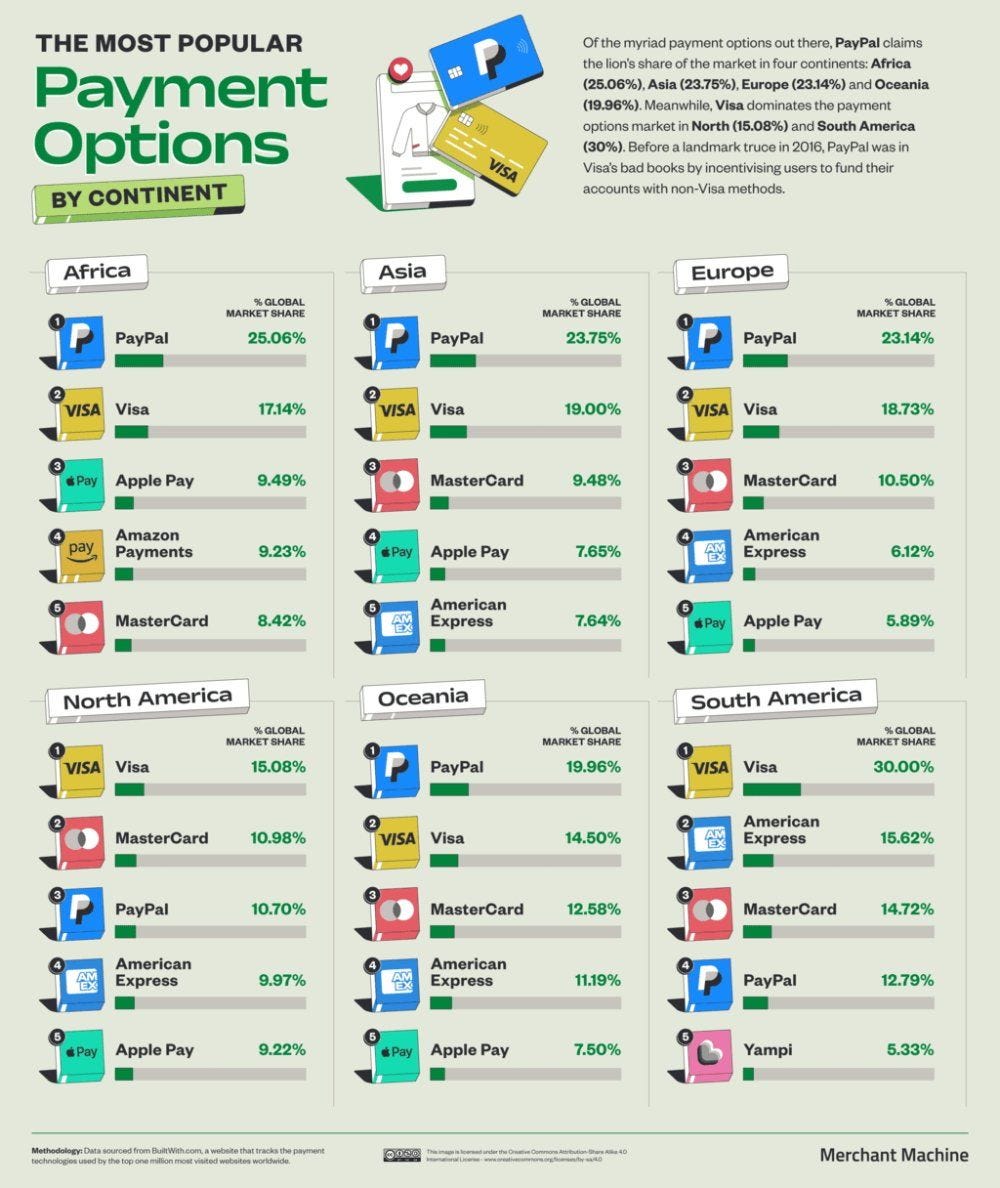

New research says that Apple Pay is only the fifth most popular payment platform in the US, despite previous claims that it was beating MasterCard.

In 2022, researchers claimed that Apple Pay had surpassed MasterCard in the annual dollar value of transactions, and by a long way.

Now according to comparison service Merchant Machine, Apple Pay is significantly less popular than MasterCard.

Square generated gross profit of $888 million, up 18% year over year, and Cash App generated gross profit of $968 million, up 37% year over year.

Canadians’ reliance on their smartphones continues to increase. Interac data reveals a 53% jump in the use of Interac mobile payments in stores and a 17% surge in its use for e-commerce purchases between August 2022 and July 2023.

Over 1 billion of these mobile transactions have taken place within a 12-month period for the first time ever.

Open banking, the ground-breaking financial technology, has reached a significant milestone, surpassing 11.4 million payments in July 2023. This achievement reflects a 9.3% increase in total payments compared with the previous month, highlighting the growing adoption of open banking services.

🧐 ANALYSIS

How do payment apps interact with banks in India and China?

The diagram below (made by Hua Li) shows a comparison between UPI (Unified Payments Interface) in India and NUCC (NetsUnion Clearing Corporation) in China.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 PAYMENTS HIGHLIGHTS

⭐️ SHEIN and Klarna are collaborating to launch Styletopia, the ultimate pop-up shopping experience.

⭐️ PhonePe dives into stock and mutual fund arena.

⭐️ Weave introduces Scan to Pay to Payment Suite.

⭐️ Zilch hits 3.5m customer milestone.

⭐️ MoonPay has launched its new investment arm, MoonPay Ventures, to support fintech and Web3 start-ups.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

GoCardless has partnered with Commusoft to offer its customer base cost-effective payments via open banking.

EUROPE 🇪🇺

WALBING has obtained a Payment Service License from the German Federal Financial Supervisory Authority. This license enables companies based in Germany to provide payment services in accordance with the German Payment Services Supervision Act (ZAG).

ING Bank is facing a lawsuit involving millions of euros from Efri, a group representing about 300 potentially defrauded investors.

Klarna has once again taken the lead in AI-adoption as one of the first early leaders deploying ChatGPT Enterprise, which brings the power of AI to all Klarna employees with beefed-up security, higher-speed and advanced data analysis capabilities.

Klarna reported its H1 results for 2023, which includes a profitable month in the second quarter ahead of target, successfully aligning with its strategic focus on both profitability and growth.

USA 🇺🇸

Solana Pay is now integrated with Shopify, enabling enterprises on the e-commerce platform to leverage the protocol for transactions.

Starbucks is testing a new way for customers to pay for their favorite beverages — without even having to pull out their phone.

Affirm shares rocket 28% after better-than-expected results and strong guidance. The company also offered solid guidance for the fiscal first quarter.

Zip has denied claims that they are set to quit the U.S. market. According to the company, the U.S. continues to be a primary piece of its strategy despite already retreating from other global markets.

VSoft Corporation has partnered with Pidgin to bolster its ability to take real-time payments, and improve its efficiency.

Venmo is partnering with greeting card manufacturer Hallmark to let you send a physical gift card loaded with money.

Mastercard and Visa are preparing to raise credit card fees in a move that could cost merchants an extra half a billion dollars a year, according to the Wall Street Journal.

US Bank and Elavon have launched a new point-of-sale (POS) solution to help small business owners avoid making a “large upfront investment” when purchasing a new payments system.

ASIA

State Bank of Vietnam (SBV) has officially joined the Regional Payment Connectivity (RPC) initiative. The RPC initiative was established to strengthen and enhance collaboration on payment connectivity through the development of faster, cheaper, more transparent, and more inclusive cross-border payments.

AUSTRALIA 🇦🇺

GoCardless and Xero renew partnership to help small businesses navigate tough economic times.

Touch2Pay acquires Thumbzup Australia, strengthening its terminal aggregation strategy.

Till Payments is in trouble, the latest in a string of local payment companies teetering on the brink. Its board, however, is confident that existing shareholders will step up to keep Till afloat as its fast-growing revenues turn into profit.

AFRICA

Fawry plans to launch a digital bank this year. This comes weeks after the company announced its plan to obtain a digital bank license from the Central Bank of Egypt.

MOVERS AND SHAKERS

Flash Payments have announced that Andrew Porter has recently joined as Chief Commercial Officer.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.

-