Google partners with Affirm and Zip to bring BNPL natively into the Google Pay wallet | 2023 #37

Weekly news up to Thursday, 14th of December 2023

Hi There, you fellow Payments Enthusiast!

Welcome back to this fresh newsletter, a dedicated Payments bulletin packed with Digital Payments and PayTech-related news!

Alright, let’s dive into this week’s hot payments news! 🚀💸

📣 This week’s main topic:

Google adds BNPL options to mobile wallet

👉What happened?

· Google is teaming up with Zip and Affirm to offer buy now pay later options for US consumers shopping with Google Pay.

· Users will be able to select Affirm or Zip as BNPL providers on the list to split their payments into regular instalments.

🤔Why is this relevant?

· Recognising the pivotal role of payments in customer experience, the collaboration seeks to simplify payment processes for customers.

· BNPL providers in general face difficult times, due to stricter regulations and an increasing emphasis on consumer protection.

· A partnership like this with Google, and thus benefit from the success of mobile payment solutions, fits into a survival strategy.

· Furthermore, it’s worth noting that Apple announced Apple Pay Later, their native BNPL option, earlier this year and it rolled out to all U.S. users in October.

· Beginning with a pilot in Q1 of calendar year 2024, Affirm and Zip will appear as a payment option for Android users on select merchant apps and websites that offer Google Pay at checkout.

👉 You can read the full source article about the partnership over here

Now over to you: could this be a game-changer for BNPL providers?

Happy to read your thoughts and vision on the interesting future of B2B payments, feel free to share them below👇

💡Any other notable things happened in Payments?

⭐️ Apple has offered to let rivals access its tap-and-go mobile payments systems, by Reuters

🤝 Payments firm SumUp defies FinTech slump with €285 million fundraising, by Bloomberg

I hope these quick bites have brought you up to speed again, and let’s keep a close eye on ‘Payments’ for the week to come..;-)

Cheerio and until the next,

Wouter

Onwards to the other payments news!

REPORT

Thunes and Kapronasia, a strategic advisory and financial services consultancy, have issued a report, “From Cash to QR codes: Unpacking Southeast Asia’s Diverse Consumer Payments Culture,” examining the region’s world-leading payment landscape.

The report explores why payment digitisation has been on the rise in Southeast Asia (SEA). The reasons for this include the growth of eCommerce post-COVID and improvements to communications infrastructure and broadband.

👀 NEWS HIGHLIGHT

Effective January 24, Amazon users will no longer be able to use Venmo on the company's website or its mobile app, the Seattle-based e-commerce giant confirmed to FOX Business.

The company said that customers will still be able to "use nearly a dozen other payment options," including debit cards, credit cards, checking accounts, or installments to pay for their orders, according to Amazon.

📰 ARTICLE

Pix, the instant payment system, has become one of Brazil's most popular payment methods. However, Pix isn't just being used for instant money transfers; it's also being employed in various unexpected ways that deviate from its original purpose.

Afterpay racked up $475 million in bad debts in the 18 months to December last year, starting 2023 – a hellish year for the buy now pay later industry – on unsteady footing.

The homegrown fintech recorded $43 billion in transactions flowing through its platform, revenue of $2 billion, and a net loss of $615 million for the period, according to accounts lodged with the corporate regulator.

💡INSIGHTS

🧐 ANALYSIS

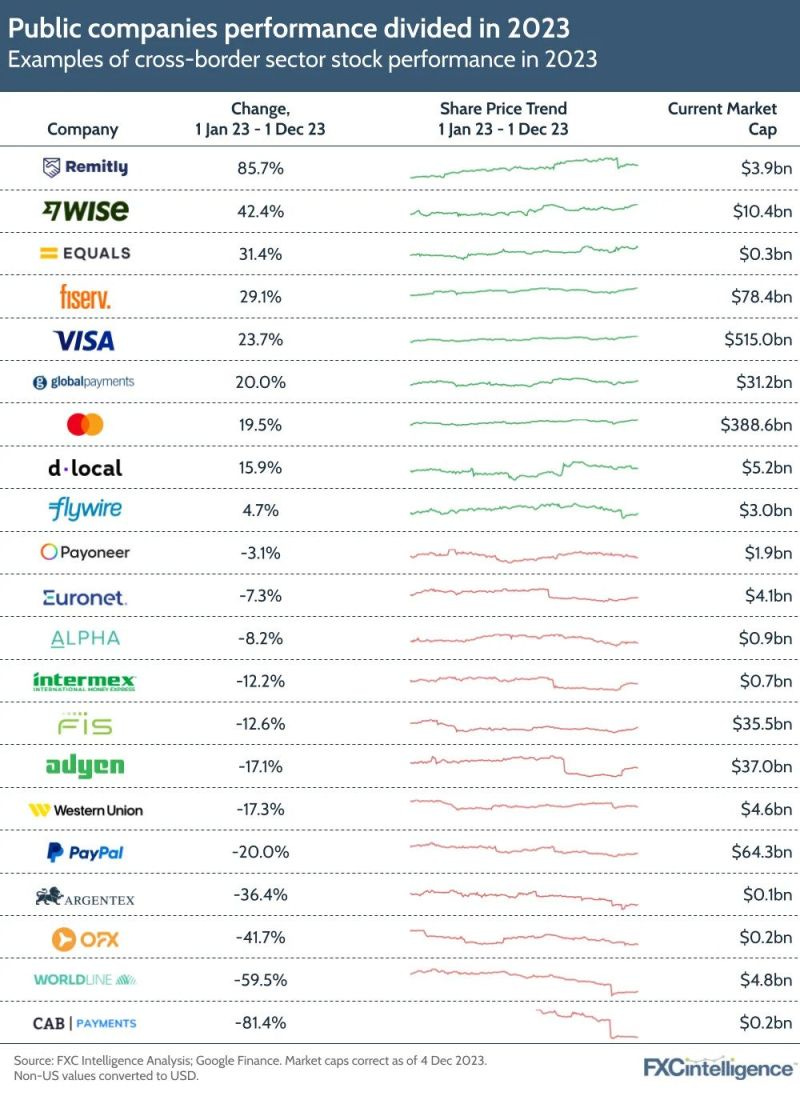

Elevated interest rates persisting in much of the world, as well as ongoing geopolitical turmoil, mean 2023 has been a challenging year for many. But how have cross-border payments companies fared? We look at the share price performance of the main publicly traded companies in the space.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 PAYMENTS HIGHLIGHTS

⭐️ Worldline Group’s subsidiary obtains Major Payment Institution licence for Singapore.

⭐️ Apple offers to let rivals access tap-and-go tech in EU antitrust case.

⭐️ Automatic Pix will be launched in October 2024, announces Central Bank.

⭐️ Hyundai Card has reported a loss of 2.27 billion Won (approx. $1.72 million) following its partnership with Apple Pay.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

UK payments watchdog proposes cap on interchange fees. The regulator is proposing a two-stage process to protect UK businesses from overpaying on interchange fees.

EUROPE 🇪🇺

Airbnb launched “Book Now Pay Later” in partnership with Klarna in Germany to allow guests to split the cost of their bookings into installments. The company is also launching “Pay Over Time” with Klarna in the UK to offer more flexible payments for guests.

French fintech Aria secures €15m to shake up business payments. The startup is taking on the $120 trillion spent on B2B payments annually and making the experience more B2C.

Visa partners with TBC to launch Visa Direct in Georgia to enable TBC customers to conduct international payments more quickly and efficiently.

Intesa Sanpaolo rolls out contactless payment ring for customers to tap and pay at the checkout. The wearable is shipped in an inactive state together with a QR code.

USA 🇺🇸

Melio taps JPMorgan to for real-time payments. This new capability enables businesses using Melio to send money to their vendors instantly.

Giddy turns to Stripe to enable a seamless way to buy cryptocurrency directly from the Giddy mobile app.

Affirm teams with Blackhawk Network to bring consumers even more choice and flexibility for purchasing gift cards.

CANADA 🇨🇦

Visa and Mastercard lower Canadian interchange fees for small businesses. Additionally, the deal sees Visa and Mastercard provide free access to online fraud and cybersecurity resources.

LATAM

The Central Bank of Colombia selects ACI to develop new domestic real-time payments ecosystem as part of a nationwide banking transformation project.

ASIA

Tourists can pay via DuitNow QR in Malaysia with My TouristPay App. Designed by Paynet to give tourists visiting Malaysia access to the DuitNow QR payment network without opening a local bank account.

Iloilo City has joined 14 other local governments in the country to adopt the central bank-backed Paleng-QR plus program and issued an ordinance that promotes digital payments in public markets and local transportation.

The Reserve Bank of India has announced a substancial increase in the UPI transaction limit for hospitals and educational institutions.

BillEase teams up with Alipay+ to roll out auto-debit feature and facilitate direct debits from customers’ credit line for transactions made with any Alipay+ affiliated merchants.

AUSTRALIA 🇦🇺

Australian BNPL Splitit delists from the stock market as investor Motive Partners takes control. The deal announced in August has now closed following shareholder approval.

Zip faces heavy refinancing burden in 2024. According to disclosures in its 2023 accounts, Zip needs to refinance more than half of its secured funding facilities next year.

MIDDLE EAST

The UAE Central Bank has joined the GCC's Afaq payments system as it aims to boost the growth and application of financial technology.

Nearpay raises $14M in Series "A" round led by Sanabil Investments with participation from stc CIF & Vision Ventures to redefine the future of payments.

AFRICA

Nigerian fintech giant, Paystack, has received a switching and processing licence from the country’s banking regulator, the Central Bank of Nigeria (CBN).

MOVERS AND SHAKERS

Checkout.com faces second round of exec departures this year and makes further staff cuts. The firm has lost 10 executives in the past 18 months and made two office closures and layoffs in the last month.

AJ Coyne joins Monzo as vice-president of marketing. AJ brings three years of valuable experience in Klarna.