REPORT

First, Stripe announced "Pay Links" for Pay by Bank payments. Now, also Shaffer Bond from Plaid presents the latest updates to 'Plaid Payments'.

Including a comparison of the daily spending habits.

According to PYMNTS Intelligence’s “Divided, Not Conquered: Acquirer and Merchant Confusion Clouds Split-Payments Landscape” report, a collaboration with Splitit, this approach to shopping has proven to be a big hit with consumers, with 3 in 5 of them telling us they used some split-payment option at least once in the last year.

👀 NEWS HIGHLIGHT

SumUp is looking to continue expanding globally, building on the four million businesses that already use its services.

The firm recently raised €285 million through a funding round led by Sixth Street late last year.

It plans to use the loan package “to refinance existing debt, as well as have firepower to take advantage of any opportunities that arise over the next six months”, Hermione Tomic, SumUp’s chief financial officer, said in an interview.

📰 ARTICLE

► Processed volume was €297.8 billion, up 46% YoY.

► Digital processed volume was up 51% YoY,

► Unified Commerce processed volume was up 30% YoY.

A Payment Orchestration Layer is a third party (most of the time) that integrates and handles the relationship with the different payment service providers (PSPs), acquirers, gateways, and banks on a single unified software layer.

In other terms, they sit in between the merchant and the entire payment ecosystem.

💡INSIGHTS

In his interview for The Paypers Cross-Border Payments and Ecommerce Report, James Butland, VP of Payment Network at Mangopay, discusses what’s in store for cross-border payments, and how they can be processed seamlessly by companies to drive cost optimisation.

FXC Intelligence compared both payment methods, including their cross-border capabilities, and here is a summary of the results:

While UPI is a decentralised payment system owned by the non-profit National Payments Corporation of India (NPCI) and regulated by the Reserve Bank of India, Pix is a centralised system owned and regulated by the Banco Central do Brasil (BCB), which has mandated its adoption amongst Brazilian financial institutions.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

⭐️ Paysafe Strengthens Us Igaming Solution With Pay By Bank Launch.

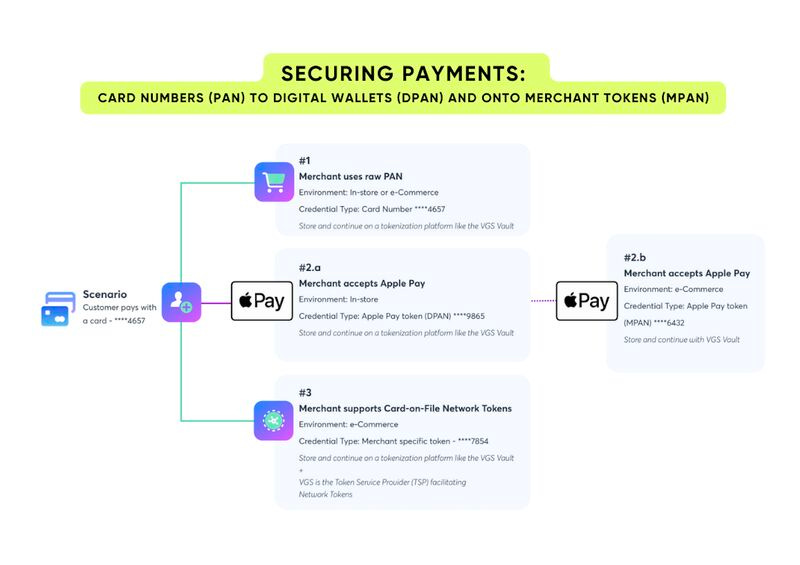

⭐️ Learn the difference between Processor Vs Network Tokens.

⭐️ Bird enters Payments! Bird Pay will accept all major payment methods.

⭐️ Visa just released an interesting report on GenAI in Payments.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Volt: Meet the FinTech taking on Visa and Mastercard’s duopoly. Tom Greenwood says the two giants have little reason to immediately overhaul their technology while they continue to see strong earnings and a dominant market position.

HSBC and PayPal are among the founding members of a new working group investigating the adoption of quantum-safe cryptography in the payments industry.

EUROPE 🇪🇺

Veritran partners with Swift. Throughout the partnership, Veritran will join the Swift Partner Programme in order to allow its collaborators to be able to provide their end users access to several Swift solutions.

Marketplace payment startup backed by BNP Paribas, 1Point6, signs first customer. In this partnership, it offers a state-of-the-art payment platform for the markets. Its brand name, a reference to the golden number, reflects the precision and efficiency of its API.

Brite delivers open banking instant payments to Shopware merchants. Shopware merchants can now easily activate Pay by Bank, which enables their customers to pay instantly, directly from their bank account.

Viva.com partners with Satispay, growing the alternative payment options for European businesses. The new partnership will enable merchants that use Viva.com’s Tap on Any Device technology for in-store purchases and Smart Checkout for online transactions, to accept payments using Satispay at checkout.

Mastercard And Prestashop Join Forces To Revolutionize Online Payments With Click To Pay. Merchants based in France, Spain, Italy, and the UK who utilize the PrestaShop platform will be the first to have access to integrate Click to Pay.

Phos and Silverflow combine on SoftPOS. The partnership combines Phos’ innovative SoftPoS technology with Silverflow’s modern payment processing platform, to offer a comprehensive and ready-to-deploy solution for banks.

USA 🇺🇸

Stripe, doubling down on embedded finance, de-couples payments from the rest of its stack. This is a big change, considering that in the past, even as Stripe grew its list of services, it required businesses to be payments customers in order to use any of the rest.

Stripe announced that it would let customers accept cryptocurrency payments in the next few months, starting with just one currency in particular, USDC stablecoins, initially only on Solana, Ethereum and Polygon.

Splitit enables banks to offer in-checkout instalment payments. The new service unlocks Splitit's merchant network to financial institutions that want to offer instalment plans to existing customers, directly at the merchant checkout.

Coupa and Bottomline bid to simplify digital payment processes for businesses. Coupa can now connect to Paymode-X, Bottomline’s business payments network that offers Premium ACH, to automate payments from buyers to suppliers.

LATAM

Chilean instant payments API startup Fintoc raises $7 million to turn Mexico into its main market. Fintoc’s product is an API that lets online businesses accept instant payments coming directly from the customer’s bank account.

FastSpring and EBANX Forge Partnership to Expand Pix Payments for Digital Products in Brazil. According to market data from EBANX’s annual study, Beyond Borders, Pix is projected to account for 40% of the total value of digital commerce in Brazil by 2026.

FinTechs Yuno and Kushki team up to optimize the digital payments ecosystem and improve the shopping experience in Latam. The collaboration between Yuno and Kushki comes at a time when e-commerce has experienced unprecedented growth.

ASIA

Unlimit Secures Online Payment Aggregator License in India and Launches Operations in the Region. This development authorizes Unlimit to operate as a payment service provider in the region.

Alipay+ enables digital payment from 14 overseas e-wallets in Hong Kong. This covers a population of approximately over 1.2 billion, allowing them to enjoy a safe and seamless payment experience in “Asia’s World City”.

The Bank of Thailand is gearing up to launch QR code cross-border payments between Thailand and India by the third quarter of this year, with plans to extend the system to become a multinational payment network spanning Asia.

Inclusive instant payment system Higala launches in the Philippines. The start-up says that of the 400 rural banks operating in the Philippines, only 4.5% are actively subscribed to InstaPay.

Groww and Worldline ePayments secure online payment aggregator licence from RBI. Groww received the licence for its subsidiary payment business, Groww Pay.

AUSTRALIA 🇦🇺

Travellers who used the real-time PayTo service will hope the troubled airline Bonza can manage refunds because, unlike with credit or debit cards, they can't fall back on a bank.

AFRICA

The Qatar Central Bank (QCB) has taken a significant stride in promoting financial innovation by approving the first cohort of ‘Buy Now Pay Later‘ (BNPL) companies for its regulatory sandbox, a pivotal part of the Third Financial Sector Strategy and the FinTech Strategy.

MOVERS AND SHAKERS

PPRO appoints Bronwyn Boyle as chief information security officer. In her role, Bronwyn will spearhead PPRO’s security strategy and oversee information, cyber and technology security across all product offerings and processes.