REPORT

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is the main secure messaging system that links the world’s banks.

The Belgium-based system is run by its member banks and handles millions of payments messages per day.

👀 NEWS HIGHLIGHT

Nexi, the leading European PayTech, announced a strategic collaboration with shopreme, a pioneer in advanced checkout technology.

The partnership will see Nexi integrate shopreme’s self-checkout solutions into its merchant propositions. The move underscores Nexi and shopreme’s shared commitment to reshaping the in-store payments landscape, leading to an era of convenience, efficiency and innovation for European consumers and retailers.

📰 ARTICLE

💡INSIGHTS

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

⭐️ TransferGo partners with Tink for international money transfers.

⭐️ Experts Weigh FedNow’s Role in ‘Mainstreaming’ Instant Payments.

⭐️ Tamatem Plus Partners With Triple-a To Introduce Cryptocurrency Payments For Gamers.

⭐️ Wells Fargo has joined JP Morgan in revealing that US authorities are investigating the handling of complaints about P2P payments service Zelle.

🌎 REGIONAL HIGHLIGHTS

EUROPE 🇪🇺

Icon Solutions announces that it has developed and launched a new SIC5 scheme pack for its Icon Payments Framework (IPF) the payments solution putting global banks in control to accelerate support for domestic instant payments in Switzerland.

USA 🇺🇸

BNPL firm Sezzle turns to gamification to encourage timely payments. Called Payment Streaks, the new feature promises to reward consumers for consistent and timely payments.

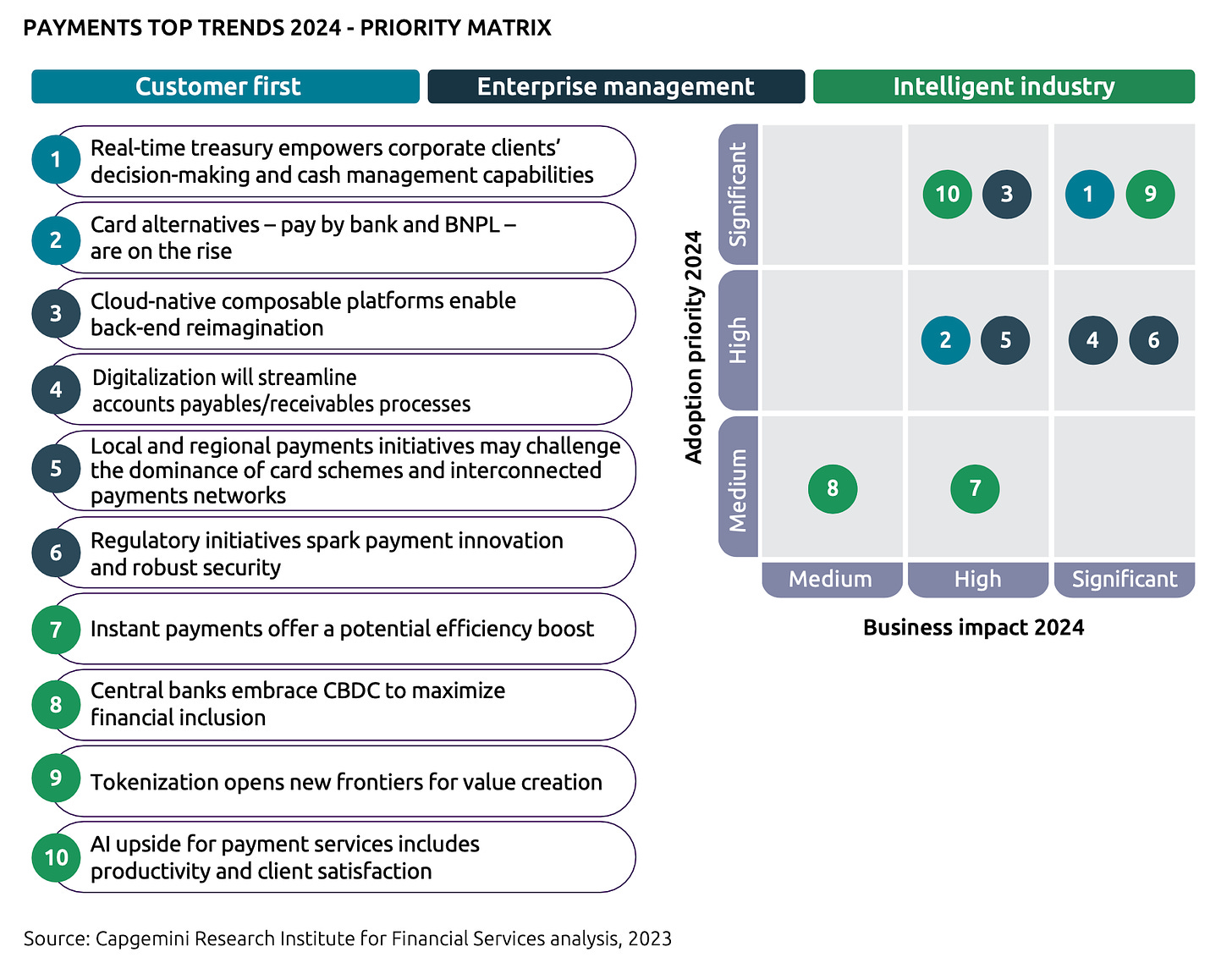

Mastercard: Tokenized Transactions Grow 50% Year Over Year. Worldwide gross dollar volume (GDV) increased by 10% year over year to $2.3 trillion. In the U.S., GDV increased by 6% to $712 billion with credit growth of 6% with credit growth of 12% and debit growth of 13%.

Payments processor BlueSnap reaches $10m settlement with FTC. The payments company, ex-CEO Ralph Dangelmaier and SVP Terry Monteith agreed to turn over $10 million for consumers and to stop processing payments for certain high-risk clients.

Juniper Research has published a new study showing that instant payment transactions are set to surpass USD 58 trillion globally by 2028, competing with card payments.

LATAM

Openpay, the payment platform of BBVA Mexico, has formed an alliance with Kueski, a company dedicated to providing personal loans, to expand electronic payment options for businesses in Mexico.

ASIA

NPCI Inks Pact With Bank Of Namibia For Developing UPI-Like Instant Payment System. This includes improving accessibility, affordability and connectivity with both domestic and international payment networks, and interoperability.

Airtel Payments Bank has introduced its own soundbox, rivaling Paytm's Soundbox and Google's SoundPod. The Soundbox, a key suite feature, delivers audio notifications for every customer transaction via QR codes at merchant shops.

Astra Tech patents first-ever palm pay technology, establishing PayBy as the only provider in the region. This proprietary technology allows users to make payments with unprecedented ease and security, leveraging advanced biometric authentication methods.

AFRICA

Nigeria’s 1.9 million PoS agents, a key part of the country’s financial inclusion drive, must now be registered with the Corporate Affairs Commission (CAC) as part of plans to improve transparency and reduce fraud.