Hello Payments Enthusiast!

Welcome to this dedicated Payments newsletter by Connecting the Dots and nice meeting you!

I look forward to the insights and connections we’ll get by interacting here.

📣 Weekly Takeaway(s):

Visa launched interoperable payments in co-op with PayPal and Venmo, and WhatsApp users in Brazil can now pay merchants through the app

👉What happened?

Visa introduced Visa+, a new service that allows users to pay and get paid across finance app

Visa is partnering with PayPal and Venmo, among others, to pilot the new interoperable peer-to-peer (P2P) payments service

Visa+ is expected to launch for US consumers with select partners in late 2023. General availability is planned for mid-2024

Later this year, users of Venmo and PayPal (both of which are owned by PayPal) in the US will be able to make a direct payment between the two platforms. Something which isn’t possible at this time

🤔 Why is this relevant?

Interoperability is considered one of the most important topics in the payments industry nowadays

It aims to remove friction in the payment flow for users, by making different systems and applications communicate with each other behind the scenes

In other words; Visa+ aims to help individuals move money quickly and securely between different person-to-person digital payment apps

To give an example: someone will be able to send money on Venmo to someone receiving it through Western Union, another partner in this co-op

There’s no need for users to have a Visa card linked to their accounts. Users can set up a personalized payments address in their preferred payments app and share that with whoever they want to transact with

👉 Read the full release here.

🤔 Anything else happened in payments?

WhatsApp is introducing the ability for users to directly pay businesses through chat in Brazil

The feature was announced a month ago but is now officially introduced

👉 What to expect from this development?

Digital payments have been rapidly adopted by people in Brazil over the last few years, with instant payment service Pix as the most notable example

Data suggests that by last year, more than 124 million people were using Pix, a platform launched and managed by Brazil’s central bank

Through the release of Whatsapp payments for businesses, people in Brazil can have end-to-end shopping experiences, from discovery to payments, within the messaging app

Until now, users could make peer-to-peer transactions through WhatsApp Pay in Brazil. But due to regulatory restrictions, Meta wasn’t able to roll out this ability to make purchases through merchants

The launch of WhatsApp Pay for businesses will unlock the merchant payment market in Brazil for WhatsApp

According to WhatsApp users can make payments through Mastercard and Visa debit, credit and pre-paid cards issued by ‘numerous’ of participating banks

👉 Read the full TechCrunch article here.

Also, keep in mind the following:

💡 Interesting read: U.S. payment giants play the long game in China

🤝 Key Partnerships: Digital River offers BNPL with Afterpay and Clearpay

As you can see, never a dull moment in payments.

Cheerio and until the next,

Wouter & Marcel

Onwards to the other payments news!

REPORT

"How Long Does It Take To Send and Receive Cross-Border Payments?"

Rapyd just released its 2023 State of B2B Cross-Border Payments after surveying hundreds of business leaders at B2B firms across Europe, North and South America on how they feel about current business outlook, upcoming market opportunities and risks, and their top considerations and priorities around B2B cross-border payments and payouts.

REPORT

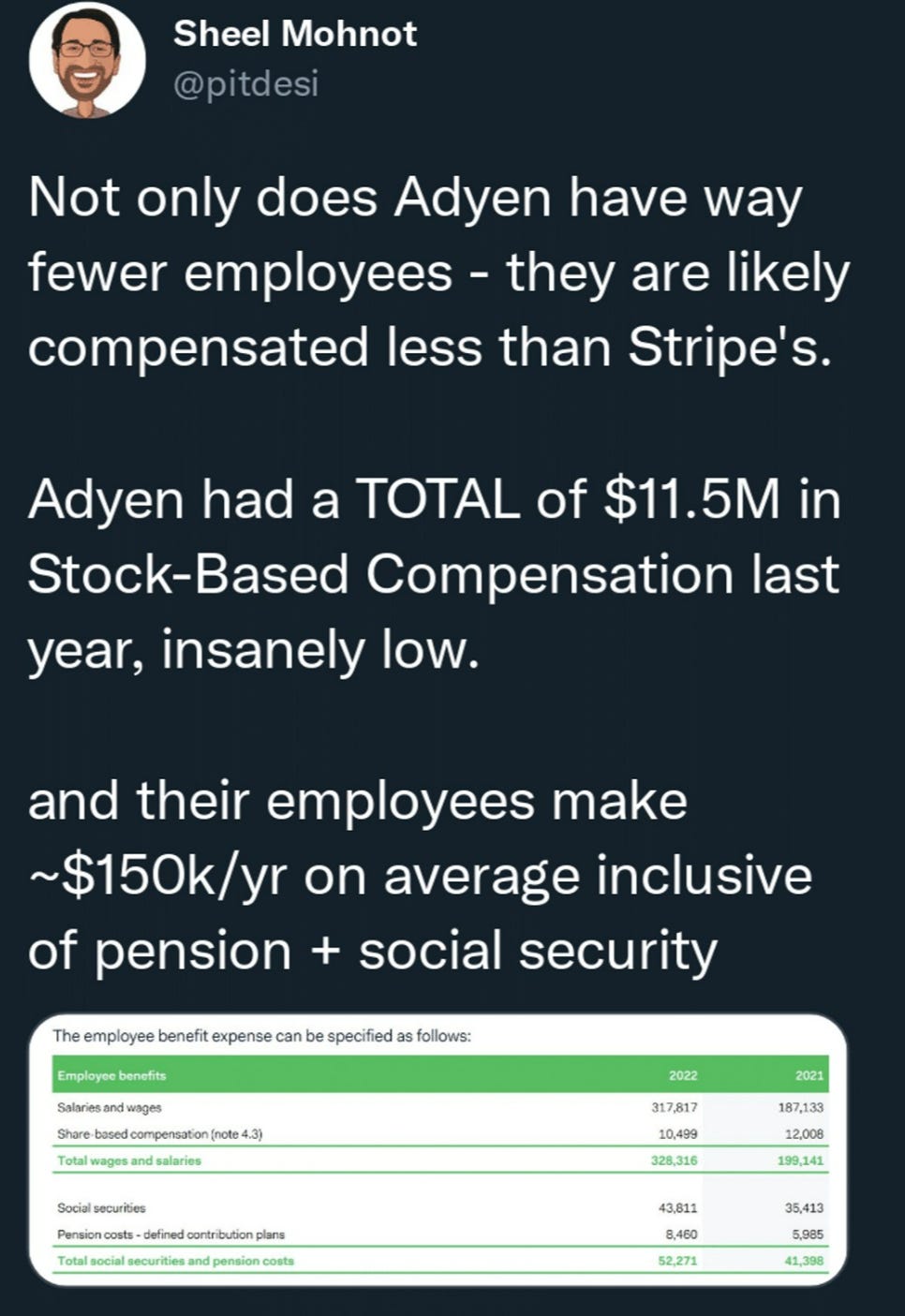

Adyen & Stripe '22 annual reports are out.

Check out Sheel Mohnot’s analysis of both reports:

Adyen processed $837B, +49% YoY (+70% in '21).

Stripe processed $817B, +26% YoY (+60% in '21)

Adyen market cap: ~$47B

Stripe valuation: $50B

👀 NEWS HIGHLIGHT

WhatsApp is officially introducing the ability for users to directly pay businesses through chat in Brazil🇧🇷

📰 ARTICLE

The largest U.S. payments firms have had their eyes on the China market for decades, in some cases since the country kicked off economic reforms in 1978.

They have waited with the utmost patience to gain access to the colossal Chinese payments and cards market, valued at US$21 trillion in 2021 by research firm Global Data. In recent years, American Express and PayPal have made some incremental progress in the China market as Beijing has gradually permitted more foreign investment in its payments sector.

📰 ARTICLE

The recent launch of Apple Pay Later saw the big tech giant become the latest firm to embrace the Buy Now, Pay Later sector as it continues to gain mass popularity.

Apple is now looking to rival some of the BNPL sector’s biggest providers, such as Klarna and Clearpay (Afterpay), as well as aiming to become an all-in-one payment gateway.

Read the full Payment Expert article by Callum Williams👇

📰 ARTICLE

The transaction value of recurring payments will exceed $15.4trn globally in 2027, rising from $13.2trn in 2023.

It attributes the slow growth of 17% to the fact recurring payments are a well-established market, but also disguises a rapid change of payment methods in the space, with open banking and digital wallet payments outstripping overall growth.

Read the full article by Fintech Global here

💡INSIGHTS

Learn the difference between a Payment Gateway and a Payment Orchestrator and their functionalities. Making an informed decision can help your business deliver a world-class customer experience, optimised transaction flow and scalable payment solution.

NOW, ON TO THE SUMMARY OF LAST WEEK'S NEWS

🔦 PAYMENTS HIGHLIGHTS

⭐️ Walmart acquired Trafalgar, an electronic payment institution in Mexico.

⭐️ Visa is partnering with PayPal and Venmo to pilot Visa+.

⭐️ From 2028, all newly-produced Mastercard plastic payment cards will be made from more sustainable materials.

⭐️ General Atlantic poured another $100 million into PhonePe, three months after leading a $350 million investment.

🌎 REGIONAL HIGHLIGHTS

UK 🇬🇧

Stripe experienced slower growth last year and processed about $817 billion in payments for its customers in 2022. That was a 26% increase over 2021’s $640 billion in payments.

Ryft secured its UK Financial Conduct Authority license. The authorization of the license opens up opportunities for the London-based fintech to be a regulated payment facilitator to the biggest acquirers.

Square announced a new integration across the UK with OpenTable, a global leader in restaurant technology. The company launched its integration with OpenTable across a number of global markets including the US, Canada, Ireland and Australia.

TerraPay raised $100m in equity and debt financing in its Series B round from IFC and supported by Prime Ventures, Partech Africa.

EUROPE 🇪🇺

Hahn Air launched a new Fintech global payment orchestration platform, FinMont, specifically for Travel Merchants.

BLIK is starting its international expansion with an ambitious goal to revolutionize cardless transactions across the bloc.

Buckaroo entered a partnership with Open SaaS platform and marketplace BigCommerce. The company aims to support growing online shops in further scaling up with reliable technology.

USA 🇺🇸

Paymerang announced the asset acquisition of KwikTag, an invoice automation provider for Microsoft Dynamics ERP systems, and the share acquisition of Sypht.

Digital River introduced Afterpay and Clearpay in its payment method offering to address consumer interest in Buy Now, Pay Later options.

Qolo have been selected to power KeyBank's integrated application programming interface (API)-based payment solutions and virtual accounts.

ASIA

Cashless payments grown to account for more than one-third of all consumption in Japan, fueled by the demand for touchless purchasing options during the COVID-19 pandemic.

AUSTRALIA 🇦🇺

Sektor partnered with iMin as exclusive distributor for iMin Android POS terminals across Australia and New Zealand.

AFRICA

Pesawise will partner with Flagright to boost its payment offering. Pesawise’s mobile and digital solutions enable customers to send and receive payments easily and securely.

If you are a fintech startup and have over 100 questions send me an email, maybe I can answer a few.